Daily Technical Analysis EUR/USD: drops to around 1.1550 despite the moderate stance on the Fed’s policy prospects

The EUR/USD pair retreats on Monday, trading around 1.1560 after gaining nearly 1.5% in the previous session. The decline comes as the U.S. Dollar (USD) rebounds from prior losses, partially regaining investor confidence.

However, the greenback may face renewed pressure following Friday’s weaker-than-expected U.S. jobs report, which triggered a notable shift in market expectations regarding Federal Reserve policy. Traders are now pricing in approximately 63 basis points of rate cuts by year-end—up from around 34 bps the day before—with the first move anticipated in September.

July’s Nonfarm Payrolls (NFP) increased by only 73,000, well below the forecast of 110,000 and down from a revised 14,000 gain in June (initially reported as 147,000). Meanwhile, the unemployment rate ticked up to 4.2%, in line with expectations.

Despite Monday’s pullback, downside pressure on EUR/USD may be limited. The Euro (EUR) remains supported by expectations that the European Central Bank (ECB) will delay rate cuts amid persistent inflation. Eurozone CPI held steady at 2.0% in July—slightly above the 1.9% forecast—signaling inflation remains above the ECB’s near-term projections. In addition, newly imposed U.S. tariffs, including a 15% duty on EU exports, have added further complexity to the outlook.

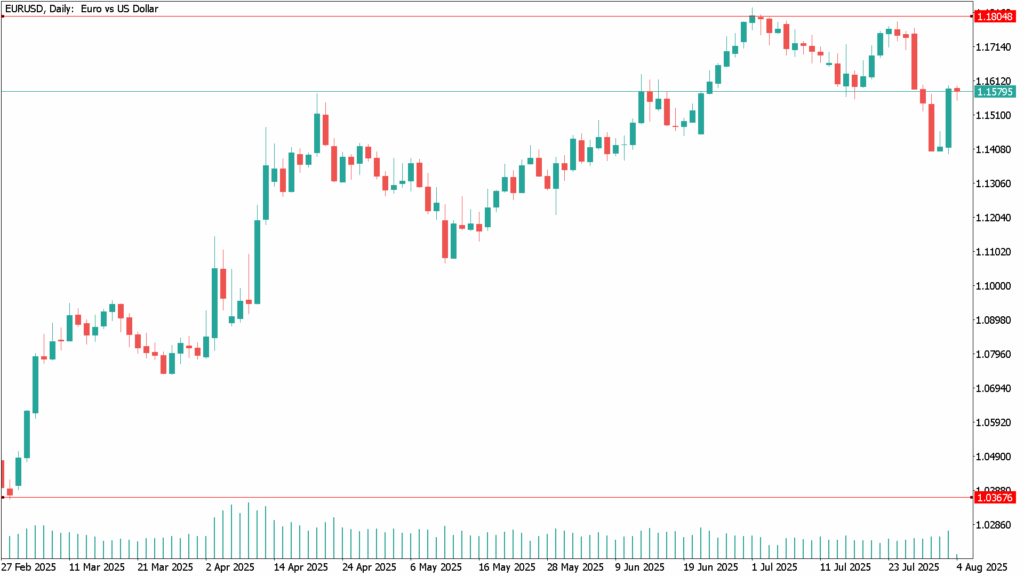

EUR/USD Daily Technical Analysis – August 4

EUR/USD rebounded from the bullish 100-day Simple Moving Average (SMA) but remains capped below the bearish 20-day SMA, which currently acts as dynamic resistance near 1.1640. Technical indicators are gradually recovering from oversold conditions, maintaining upward slopes, though they remain in negative territory.

A sustained move above 1.1640 could open the door for a test of the 1.1700 level, with further gains potentially targeting the yearly high at 1.1830. On the downside, key support lies at 1.1470, and a break below this level could expose the recent low near 1.1390.