GBP/USD Consolidates Ahead of Expected BoE Rate Cut

Approximately one hour before the ECB announces its decision from Frankfurt, the “Old Lady”—the affectionate nickname for the Bank of England in the City of London—will also publish its interest rate decision for the UK, where the Bank Rate currently stands at 4.00%. Market pricing suggests a high likelihood of a 25 basis point cut to 3.75%, a view shared by a large segment of investors, as reflected in SONIA futures, which imply roughly a 90% probability.

The backdrop is one of a deeply divided Monetary Policy Committee. Among the nine members, four dovish policymakers point to a weakening labour market and decelerating wage growth, while four hawks remain concerned about still-elevated food inflation and persistent supply-side constraints. The deciding vote is likely to rest with Governor Andrew Bailey, who at the previous meeting appeared inclined toward easing but called for additional macroeconomic evidence before acting.

Recent data largely provide that evidence. Headline CPI, with the latest release published yesterday, came in well below expectations at 3.2% year-on-year. GDP growth is slowing, with output expanding by just 0.1% in Q3, bringing the annualised growth rate to 1.3%. The labour market has also softened, with unemployment rising to 5.1% and wage growth continuing its steady deceleration since 2023, now running at only 2.4% on a three-month annualised basis. Taken together, these indicators leave the door wide open to a rate cut at today’s meeting.

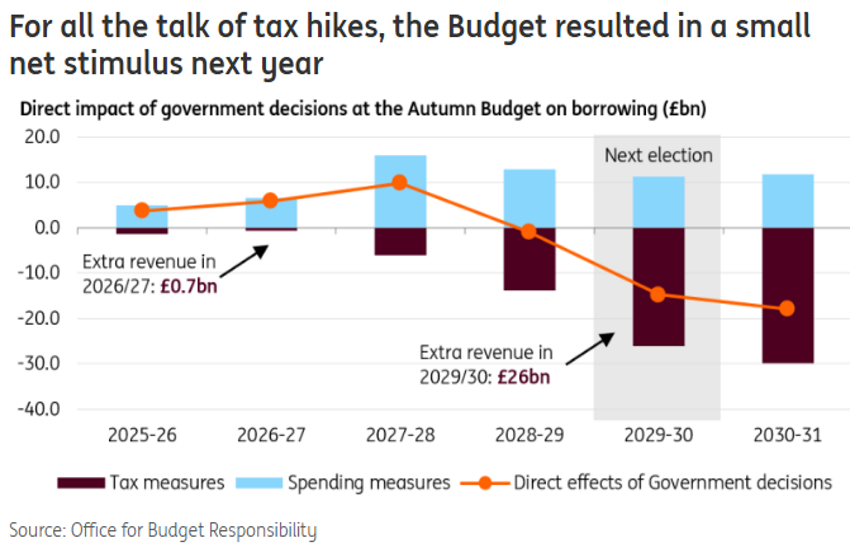

In addition, the recent Autumn Budget has, to some extent, cleared the way for monetary easing. Specific measures—such as cuts to energy bills and a freeze in train fares—are expected to shave a few tenths of a percentage point off headline inflation next year. More importantly, the timing and distribution of fiscal measures imply a modest “micro-stimulus” in 2026, with the bulk of fiscal support shifted further out along the policy horizon.

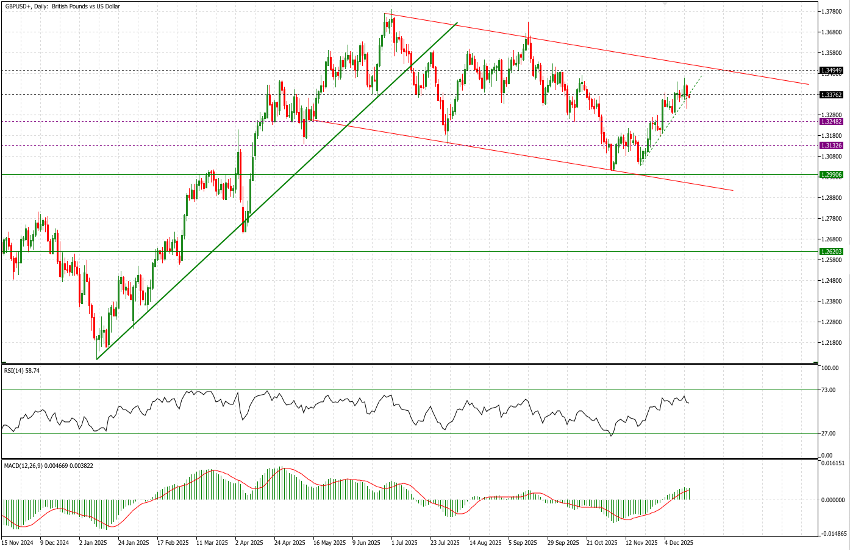

TECHNICAL ANALYSIS

GBP/USD displays a daily-chart configuration broadly similar to that of EUR/USD, albeit noticeably weaker. The early-July high at 1.3785 and the September peak at 1.3726 remain distant despite the rally of the past three weeks (current price 1.3368), in contrast to the behaviour of the euro against the US dollar. This relative weakness is evident in the downward-sloping, well-defined price channel.

The 1.2990 area, from which the latest upside acceleration originated, represents a key support/resistance zone. It was particularly important in early 2022, when—once breached—it marked the beginning of the sharp decline in the pair, first toward the 1.20 area and ultimately to 1.0325 by year-end. The slope of the rally that began on 20 November from 1.3035 appears somewhat steep, and just yesterday there was an initial attempt to break below the rising trendline. Momentum indicators remain supportive, with both MACD and RSI in positive territory.

Despite the prospect of a rate cut—or perhaps precisely because it is already largely priced in—from a technical standpoint GBP/USD could extend modestly higher, potentially testing the 1.35 area, where it would encounter the descending channel. Any sustained breakout (not expected today, and for which there is currently insufficient evidence to assess the probability) would nonetheless require confirmation above 1.36.

On the downside, areas of particular interest lie at 1.325 and 1.313. A final observation on the longer-term outlook: on the upside, the truly critical zone is between 1.40 and 1.425. GBP/USD traded above this range from 2008 to 2015, and it represents the upper boundary of the broad range within which the pair has moved over the past decade, with the lower bound located around 1.2075.