Majors, minors & exotics from 0.0 pips spread

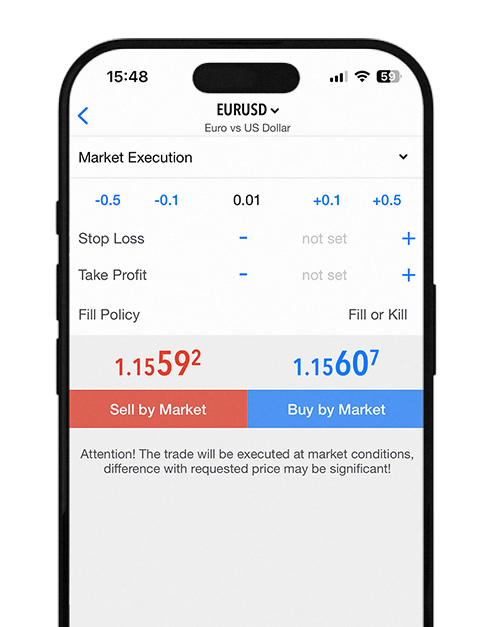

Instant currency trading with just one click

Trade more with less — zero hidden fees

Forex Currencies Trading

Trade across 40+ Forex currency pairs

Providing access to the world's largest and most liquid market with tight spreads, starting from 0 pips on EUR/USD.

Majors, minors & exotics from 0.0 pips spread

Trade more with less — zero hidden fees

Instant currency trading with just one click

Benefit from advanced trading features

Forex currencies trading overview

Explore the trading specifications for our forex market symbols. Make informed trading decisions with our transparent trading data.

Forex Pair

Contract Size

Min. Trade Size

Max. Trade Size

Trade Session*

EURUSD

Euro vs US Dollar

100000

0.01

100

00:05-23:55

USDJPY

US Dollar vs Japanese Yen

100000

0.01

100

00:05-23:55

GBPUSD

British Pound vs US Dollar

100000

0.01

100

00:05-23:55

USDCHF

US Dollar vs Swiss Franc

100000

0.01

100

00:05-23:55

AUDUSD

Australian Dollar vs US Dollar

100000

0.01

100

00:05-23:55

* Timezone is based on (GMT+3)