EUR/USD Drifts Sideways Poised to End 2025 Close to Yearly Highs

From President Lagarde’s press conference, it was clear that the ECB is currently very comfortable with its prevailing monetary policy stance following the latest adjustment to the Main Refinancing Operations rate (2.15%) implemented last June. Only a clear and material deterioration in the medium-term growth outlook would be likely to alter the Governing Council’s perception that policy is now in a “good place.” By contrast, the ECB staff projections remain relatively benign, with real GDP growth expected to range between 1.2% and 1.4% per annum over the next three years, while inflation is projected to remain persistently below 2% (at most converging to that level by 2028). It is also worth noting that one of the leading candidates to succeed Christine Lagarde, Isabel Schnabel, has recently stated that the next policy move is likely to be a rate hike.

Against this backdrop, EUR/USD experienced a relatively subdued trading session, managing to hold above the 1.17 level and ultimately closing marginally lower (-0.12%) at 1.1711. The 10-year yield differential continues to narrow, with the German Bund yield rising to 2.9068%, its highest level since 2011, which is a notable development. The US 10-year Treasury yield, for its part, remains firmly above 4% (currently 4.169%), although it is worth recalling that it began the year closer to 4.75%. That said, the Bund future—currently trading around 127.16—is approaching a key long-term support level at 126.75, which could act as a brake on the ongoing compression of the yield spread.

TECHNICAL ANALYSIS

The euro has strengthened significantly so far in 2025, having started the year close to parity (1.0354) and decisively breaking above the highs holding since March 2022 in the 1.12 area. After successfully retesting that level in May, the pair resumed its upward move, eventually reaching a peak at 1.1920 on 17 September. That said, momentum has clearly faded since at least July—likely reflecting relative convergence as both the ECB and the Federal Reserve approach the end of their respective easing cycles—and price action has since consolidated within a broad range between 1.1485 and 1.18. The upper bound of this range was tested again last week, after which EUR/USD has drifted modestly lower, by less than one big figure (or “handle,” in market parlance).

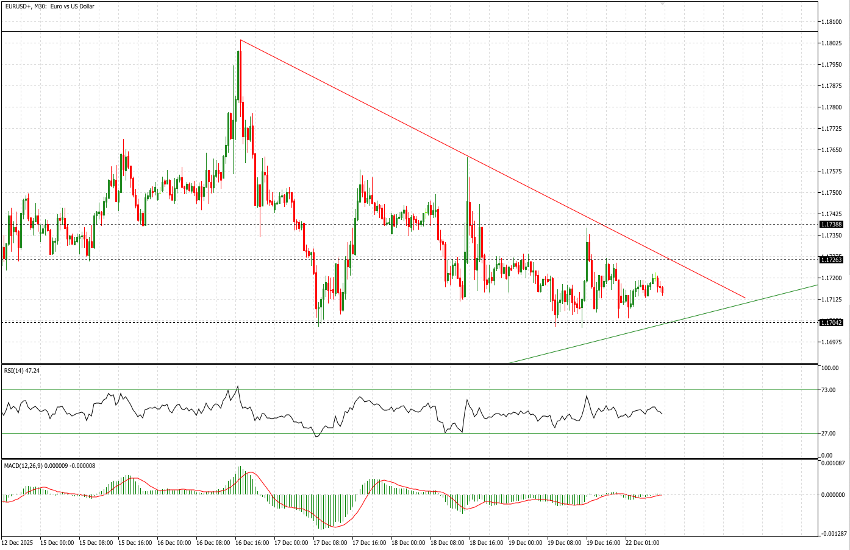

On the 30-minute chart, the descending trendline originating on 16 December is clearly visible, while the rising trendline—highlighted in green and originating on 21 November—remains intact for now. As a result, we expect a relatively compressed trading session today, with price action likely confined, at least during the morning, to the 1.1705–1.1725 range. A confirmed break, defined as at least three consecutive candles beyond the range, would open the door to a directional extension. Additional static levels to monitor include 1.1716 and 1.1738 on the upside.

No major market-moving data are expected today. The UK GDP release should have limited impact on EUR/USD, while US Treasury auctions—3- and 6-month T-bills and the 2-year note—could represent a window for more pronounced price action, although this would be confined to the 16:30–18:00 GMT time window.