GBP/USD: A Strong Pound and a Federal Reserve Under Pressure

Over the past several weeks, the USD had experienced a series of modest appreciation sessions, clearly visible against both the Euro and the Swiss Franc. This move unfolded within a persistently low-volatility environment, which has kept the USD Index trading broadly sideways throughout the entirety of H2 2025, following a pronounced depreciation in the first half of the year.

Yesterday, this trend temporarily stalled, primarily due to market reactions to a piece of news that, for daily market participants, should not have come as a surprise: the indictment of Fed Chairman Jerome Powell for the alleged misuse of funds related to the renovation works at the Federal Reserve’s Washington headquarters. Reportedly, costs overran the initial budget by approximately USD 600–700 million. While the official indictment by the Department of Justice was announced yesterday, the issue itself has been widely known for months, as have President Trump’s intentions to exert influence over the Fed’s monetary policy decisions.

As recently as September 2025, Stephen I. Miran was appointed by the U.S. President as a new voting governor on the Federal Reserve Board. From the outset, he has positioned himself as a clear advocate of President Trump’s preference for more accommodative monetary policy, frequently—and in practice consistently—dissenting from the rest of the Board in favor of looser policy settings.

Another key factor to consider is that Powell’s term as Chairman expires in May of this year. He is therefore in the final stretch of his mandate and is unlikely to undertake any abrupt or unconventional actions—a stance that is, in any case, characteristic of central bankers. That said, this blending of political pressure and monetary policy runs counter to the principles of liberal market economies and inevitably brings to mind episodes such as “Erdoganomics,” when the Turkish president imposed unorthodox views on the central bank, removing officials who failed to align with his stance.

Without delving further into these dynamics, attention now turns to the USD’s trajectory against the British pound—one of the stronger major currencies in recent months—particularly in light of several noteworthy UK economic data releases scheduled for this week.

TECHNICAL ANALYSIS

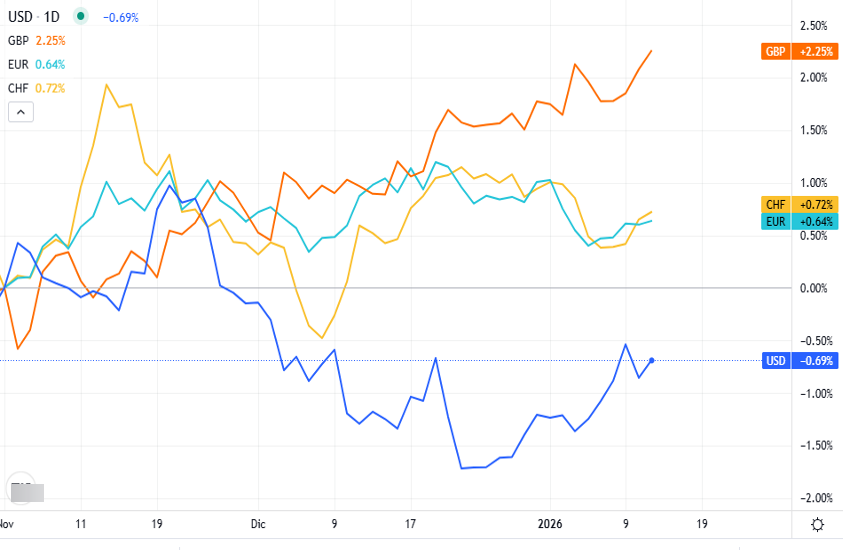

The British pound has been the strongest currency among those in the “European” geographic bloc over the past two months. Its currency index has risen by approximately 2.25%, compared with broadly flat performances in the euro and the Swiss franc, and a slight depreciation of the USD (see chart below). This strength has emerged despite a macroeconomic backdrop that can hardly be described as robust: GDP expanded by just 0.1% in Q3 2025, the unemployment rate increased to 5.3%, and growth has been sustained primarily by the services sector. By contrast, manufacturing remains depressed, with industrial production recording its steepest decline since 2021 in September (-2%).

On the 4-hour chart below, the upward trend in GBP/USD that began in November is clearly visible, along with the recent consolidation phase within the 1.34–1.3530 range, which has been in place since December 20. Mild divergences can be observed on both RSI and MACD; however, these are also consistent with a pause or consolidation phase and do not necessarily signal an imminent trend reversal. The market’s reaction to yesterday’s news is evident in the last nine candles, which show a sharp rebound from 1.3391 to 1.34845.

We do not believe that this news will have further material repercussions. That said, it remains possible that the pair may attempt a marginal push higher. Currently trading around 1.3468, GBP/USD could, on an intraday basis, retest yesterday’s high and potentially extend toward the 1.35 level, where a very weak bearish reaction may emerge. The next upside target would then be 1.3530.

Overall, however, we do not see scope for a decisive move in the coming hours or days. Our base case is that GBP/USD will continue to trade in a predominantly sideways fashion. On a daily perspective, the pair has spent recent months oscillating mainly between the upper boundary around 1.3590 and key support levels at 1.33 / 1.3250, with occasional but very brief excursions toward 1.31 / 1.315. In short, FX market volatility remains subdued.