Goldman Sachs exceeds profit expectations, nears $1,000

As anticipated in this week’s Weekly Outlook, the U.S. earnings season has begun, as usual led by the banking sector.

Expectations were relatively elevated, as banks typically provide a reliable read-through on the overall state of the economy and credit conditions. In addition, sector performance since mid-November 2025 has been decidedly strong: the Invesco KBW Bank ETF gained 19.81% between 19 November and 6 January, broadly in line with its European counterpart, with the STOXX Bank Index up 18.12% over the same period.

All of the U.S. “Big Six” banks have now reported results—JPMorgan, Wells Fargo, Citi, and Bank of America earlier in the week, followed yesterday by Morgan Stanley and Goldman Sachs, on which we focus here. Overall, the tone of the earnings season has been constructive. Banks reported encouraging signs of resilience from the U.S. consumer, solid credit demand, and loan-loss provisions generally lower than analysts had feared. Trading divisions delivered strong results, and management commentary pointed to improving prospects for core investment banking activities—namely mergers and acquisitions, IPOs, and broader capital markets activity—heading into 2026.

Turning specifically to Goldman Sachs’ results, the bank reported a fourth-quarter profit that exceeded Wall Street expectations, supported by robust performance in equities trading as well as asset and wealth management. Net income rose 12% year-on-year to USD 4.62 billion, equivalent to USD 14.01 per share, reflecting gains across its capital markets businesses. Total revenues amounted to USD 13.45 billion; while this represented a 3% quarter-on-quarter decline, management noted that the shortfall was largely attributable to the off-loading of the Apple Card loan portfolio to JPMorgan and the early termination of its partnership with the technology company.

Overall, the results reinforce the view that Goldman Sachs’ Wall Street-centric business model is performing well in the current environment. Elevated equity valuations, easing interest rates, increased engagement from institutional investors, and persistent global geopolitical and macroeconomic uncertainty—driving volatility across commodities and foreign exchange markets—have all continued to provide a supportive backdrop for investment banks.

TECHNICAL ANALYSIS

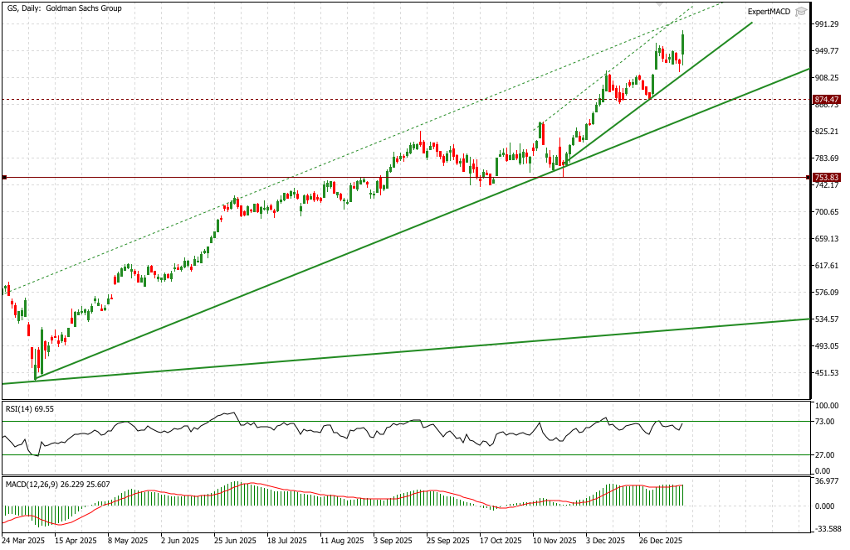

The daily chart of Goldman Sachs tells the story of an almost exceptional year. At the beginning of spring 2025, on 8 April, the stock was trading at USD 442; it closed yesterday at USD 974.27, marking a gain of approximately 120% over the past nine months.

We have drawn a long-term trendline starting from that low and extending to the beginning of the new and stronger impulse observed in the sessions between 18 and 24 November. From that period onward, an acceleration in the price action is evident, defined by a higher relative low formed on 31 December, which ultimately led into yesterday’s results.

Parallel lines have been added to both trendlines in an attempt to define price channels, although these still lack full confirmation. Nevertheless, in both cases the implied target of the move appears to converge toward the psychological USD 1,000 level, with an estimated range between USD 995 and USD 1,010. This scenario is also consistent with strongly positive technical indicators that are not yet in overbought territory (for example, the RSI stands at 69.55).

Overall, the technical picture remains constructive at this stage.