Nasdaq Remains Below Its Late-October Peak

It is quite striking to see how Nasdaq valuations have managed to remain so elevated, standing just 3.27% below all-time highs after yesterday’s strong rebound to 25,326 (+1.36%).

We highlight this in light of the less-than-stellar recent performance of its major constituents, namely the large-cap tech stocks. Yesterday we discussed Apple, the second-largest component of the index by weight—accounting for 11%—which is now firmly in corrective territory, down 14% from its highs. But Apple is not alone. Microsoft is down 19.65% from its late-October highs and, with a 10% weight, is the third most important name in the index overall. The fourth, Amazon, has fared somewhat better but is still down 10.64% from its highs, also reached in late autumn on November 3. Even the flagship of the AI-driven rally and the largest index constituent, Nvidia, is down 13.60% from its peak of $212, also set in late October; Meta is down 22%.

Alphabet (GOOGL) is holding up relatively well, but the key dynamic here clearly lies in rotation toward companies that appear to have genuine profit prospects during this phase of massive technological infrastructure build-out. As a result, we see Micron surging, up 75% since mid-December, while AMD continues to push higher. Both, together with other names specifically within the semiconductor sector (the iShares ETF, notably, is at all-time highs), are helping to prevent the index from performing significantly worse.

TECHNICAL ANALYSIS

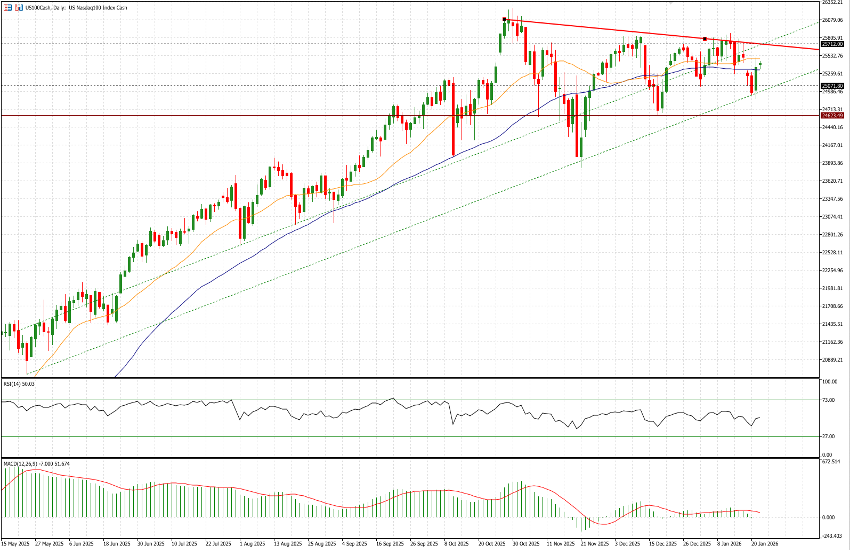

The US100Cash—this is the name under which you will find it on our MT5 platform—is currently trading at 25,406, adding a further +0.22% relative to yesterday’s close. Price action is confined between the 21-day and 50-day moving averages, both of which—quite significantly—are completely flat, indicating a lack of bullish momentum.

Yesterday’s rebound found support along the trendline drawn from the May 23 lows and confirmed by the rebound on November 21 around the 23,850 area, after the index had declined from the 26,100 zone. This level remains the all-time high, and at this point it should come as no surprise that it was reached on October 30.

The RSI is currently in fully neutral territory at 50.45, while the MACD is marginally positive, but only just. In short, the market is in a consolidation phase which—at least for today—could allow the index to push toward a retest of yesterday’s highs at 25,500 and potentially, over the next few sessions, toward 25,700. That area could become the battleground between bulls and bears for control of the next directional move.

On the downside, close attention should be paid to today’s low at 25,330 (notably also the level of the gap left open on October 24), followed by 25,250, 25,050, and finally the 24,900 zone. A downside break below this level would be far from encouraging; in that case, 24,600 would become a key level to watch in order to avoid a more prolonged correction toward 24,000.