EURGBP Weak Macroeconomic Data

A few minutes before the release of a new set of UK price data—covering consumer, producer, and retail figures—virtually every macroeconomic indicator published in the United Kingdom over the past two weeks has pointed to a stagnating economy and strongly argues in favor of a rate cut at the next Bank of England meeting. The pound sterling has accordingly remained weak, both against the euro and the US dollar.

In sequence, quarterly GDP came in essentially flat and below expectations. This was followed by declines in both industrial production and manufacturing output on a month-over-month basis. Finally, labor market data showed a higher-than-expected unemployment rate (5.2%), which is also trending upward. Wage growth has likewise slowed relative to forecasts—an arguably positive development, as it suggests easing inflationary pressures.

As early as February, the vote within the Monetary Policy Committee of the Bank of England was notably divided, ending 5–4, with nearly half of the members already favoring a rate cut to 3.5% at that time. The market now expects such a move to materialize at the upcoming March meeting.

TECHNICAL ANALYSIS

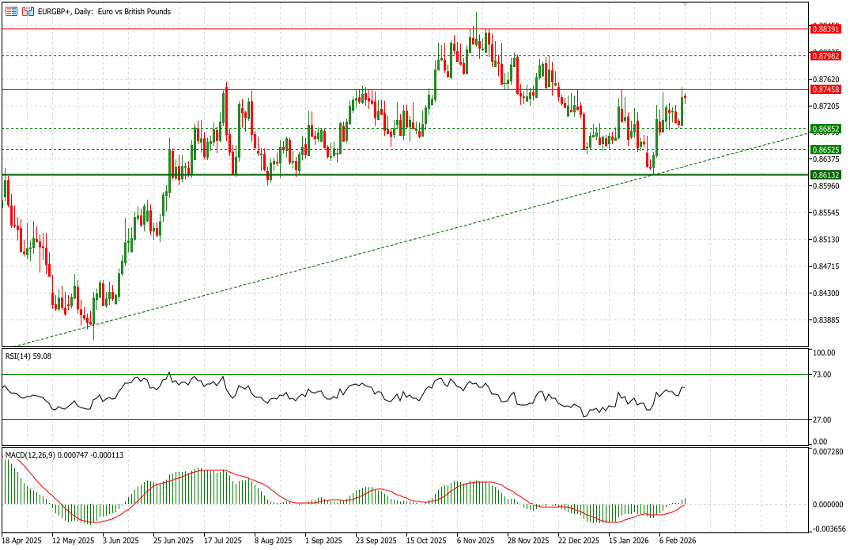

EUR/GBP has been holding around the 0.8600 area since early June 2025, a level that previously acted as a launchpad at the beginning of the summer for a move first toward 0.8750 and subsequently toward 0.8840. More recently, on 4 February, the pair retested this support after several months, following a downward move from the upper end of the previously mentioned trading range.

From a technical indicator perspective, the MACD is turning higher and has just moved back into positive territory, signaling a potential recovery in upside momentum. The RSI remains broadly neutral but is nonetheless printing 58, indicating a moderate bullish bias without yet entering overbought territory.

The 0.8750 level represents a major resistance area; however, we believe it could be breached in the coming days, opening the way first toward 0.8800 and subsequently 0.8840. On the downside, initial risk is seen at 0.8685, followed by stronger support at 0.8650.

We believe that the relatively clear prospect of a more accommodative stance from the Bank of England compared with the European Central Bank, alongside a marked decline in inflation, is not yet fully priced in by the market. This dynamic should favor further euro appreciation, potentially toward new relative highs between now and the 18 March meeting.