WTI Reclaims $65 on Middle East Tensions

A few weeks ago, at the beginning of January, when crude oil was finally rebounding from the $57.5–$60 area, we highlighted the importance of the $66 level—a threshold that had acted as a floor since 2022 and had been broken to the downside only last April.

Admittedly, according to OPEC and EIA data, the world is experiencing a slight oversupply, which justifies relatively low prices from a 10-year perspective. At the same time, however, numerous geopolitical tensions remain, ranging from the situation in Venezuela to—far more importantly—that in Iran.

On Tuesday, meetings took place in Geneva between U.S. and Iranian delegations. While initial comments from officials in the Middle Eastern country seemed to suggest a constructive path toward dialogue, Vice President Vance partially contradicted that interpretation yesterday, stating that the parties remain far apart on certain red lines and that the military option is not off the table.

Adding to this, Iran conducted military exercises in the Strait of Hormuz—a passage through which roughly one-third of global oil shipments transit—and claimed to have temporarily closed it (a report denied by Western sources).

All of this was more than sufficient to push WTI up 4.61% yesterday to $65.20, marking one of its strongest daily performances in several months.

Technical Analysis

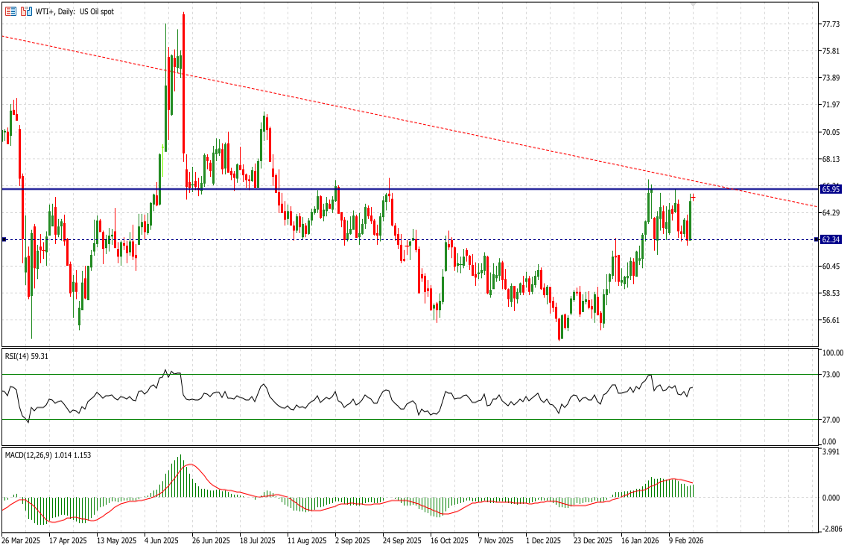

West Texas Intermediate (WTI) has finally gained sufficient momentum to trade within a new, higher range between $62.35 and $66. A clear breakout and daily close above $66 would likely pave the way for further upside, potentially restoring $66 as a structural support level over the longer term.

The descending red dotted trendline represents the bearish trajectory in place since September 2023. Caution is warranted here, as WTI’s volatile price action has distorted this trendline over time—meaning different traders may have drawn it with slightly different angles.

Above $66, prudence remains advisable until a decisive break of $66.80 is confirmed. A move beyond that threshold should open room for further extension, with $69.50 emerging as the first upside target.