AUDJPY Reaches Multi-Year Highs Post Japanese Elections

It appears that in last night’s elections in Japan, President Takaichi’s Liberal Democratic Party (LDP) is on track to secure a supermajority. According to NHK reports, the LDP is projected to win 273 seats and its coalition partner, Ishin, 24 seats in the Lower House as of 11:30 p.m. local time. This outcome would give the coalition a two-thirds majority, sufficient to override vetoes from the Upper House. Such a result would grant Takaichi greater latitude in policymaking and strengthen her ability to pursue both economic and foreign policy objectives.

Her main stated priorities include a two-year reduction in food taxes and an increase in military spending, which she claims will be pursued with due regard for fiscal sustainability.

Following the election outcome, the Nikkei surged by 5% at the open to new all-time highs. At the same time, the Japanese yen temporarily paused its depreciation toward the 160 level against the US dollar, a move that nonetheless appears intact over the medium term. This reflects both the currency’s underlying weakness and investor concerns over a potentially aggressive fiscal program (and the associated deficit), which nonetheless is not expected to accelerate the Bank of Japan’s monetary tightening cycle. At present, we continue to anticipate the next rate hike only in June.

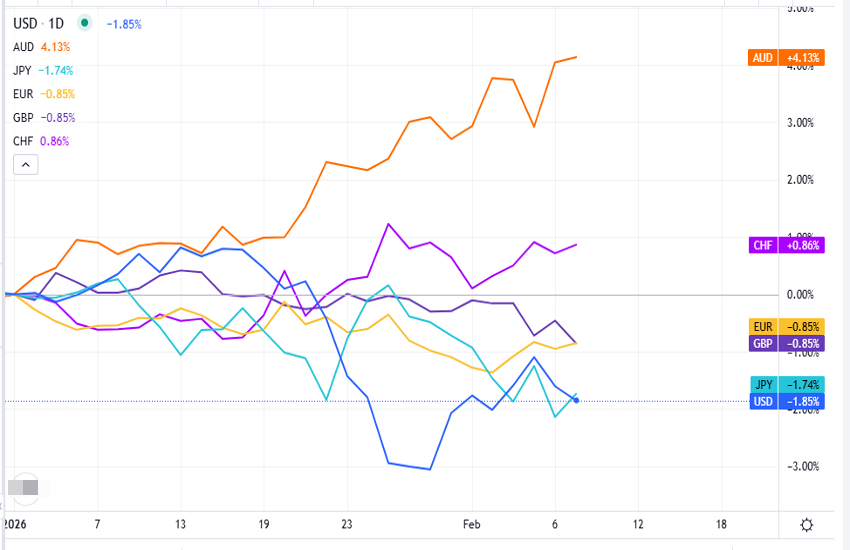

By contrast, just a few days ago the Reserve Bank of Australia raised interest rates as expected to 3.85%, in response to persistently elevated inflation, which in the latest reading stood at +3.8%. This move has provided fresh momentum to the Australian dollar, currently the strongest-performing currency year-to-date, as illustrated by the relative strength chart below.

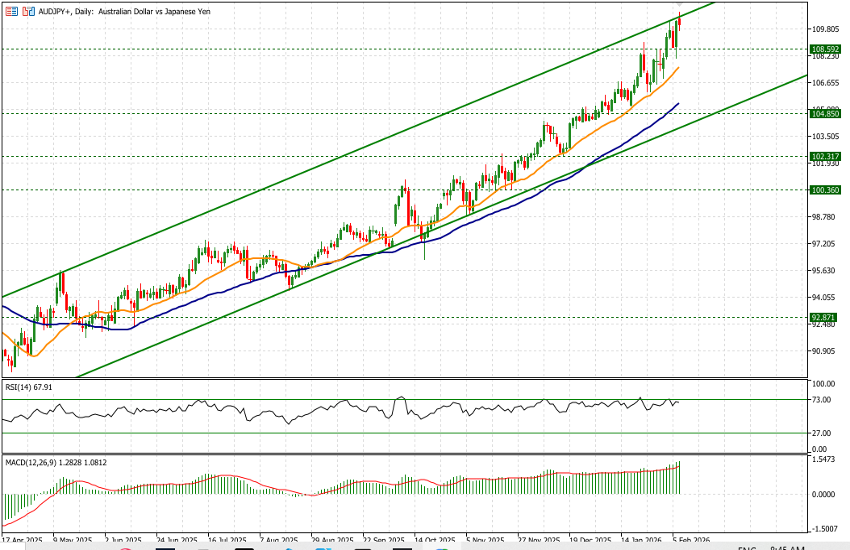

Let us now take a closer look at the evolution of the AUD/JPY cross.

TECHNICAL ANALYSIS

AUD/JPY is one of the few major yen crosses currently trading above its previous highs. This morning it reached 110.78 before retracing with some conviction toward the current 109.96 level, down 0.27% on the day. Price action remains very orderly within a rising channel that began roughly one year ago from the 87.50 area.

If we consider this channel to be valid, it suggests that a short-term pause in the clearly bullish trend may be approaching. The most natural outcome in such situations is a period of consolidation over several sessions, allowing the lower boundary of the channel to catch up and resulting in a more sustainable, less stretched pace of advance. At present, the lower boundary of the channel lies around 105; however, under the scenario outlined above, it is reasonable to expect any interaction with the trendline to occur somewhat higher, likely around 106.60.

In any case, the 108.60 area should represent strong support, as it corresponds to the previous high from July 2024. Also worth monitoring are the two standard moving averages—the 21-day and the 50-day—particularly the faster one, which currently stands at 107.55.

In summary, at current levels we would look for new entry points slightly below prevailing prices, maintaining the view that the trade remains one of selling the yen. That said, close attention should be paid to developments in Japan’s fiscal outlook over the coming months, as this could represent one of the few genuinely significant factors capable of driving a medium-term shift in direction—though such a scenario still appears distant for now.