Daily technical analysis EUR/USD: bounces back to 1.1050 after Tuesday’s decline

EUR/USD fell nearly six-tenths on Tuesday, finding a slight bounce from the 1.1050 level, as geopolitical tensions and sour economic data unnerved flows regarding risk appetite, serving to bolster the dollar and dragging Fibs to their lowest prices on record in nearly a month.

Inflation in Europe as measured by the Harmonized Index of Consumer Prices declined in September at a faster pace than previously thought. Year-on-year core HICP inflation fell to 2.7% y/y, while month-on-month headline HICP inflation also fell to 1.8% during September, an even faster decline from the previous 2.2% than the estimated 1.9%.

Economic data in Europe will take a back seat for the remainder of the week as investors focus on Friday’s nonfarm payrolls report. In the lead up to Friday’s Non-Farm Payrolls report, a trickle of considerable economic data on the whole, albeit lacking in individual significance, seems to leave the picture unclear, and investors seem to be faced with somewhat lackluster releases that generally hit the bank.

For the month of September, the U.S. ISM manufacturing PMI remained at the 47.2 level for the second month in a row, below the estimated increase to 47.5. Additionally, ISM manufacturing prices paid remained at 47, below estimates. Also, ISM manufacturing prices paid declined to 48.3 down from 54.0 previously, which seems to be a sign of contraction.

Now, speaking of U.S. employment data, August JOLTS job openings increased to 8.04 million, surpassing the revised 7.7 million last period. Despite this, the increase in job openings is not likely to turn somewhat directly into further contractions, as the ISM manufacturing employment index for September declined to 43.9 from 46.0 previously, missing the estimated rise to 47.0.

In terms of geopolitical concerns, investors’ attention has focused on the Middle East after learning that Iran conducted a missile strike against Israel in response to Israel’s recent ground incursion into Lebanon. The U.S. has pledged to respond in support of Israel, which has investors wary of the possibility of an escalation of the current conflict.

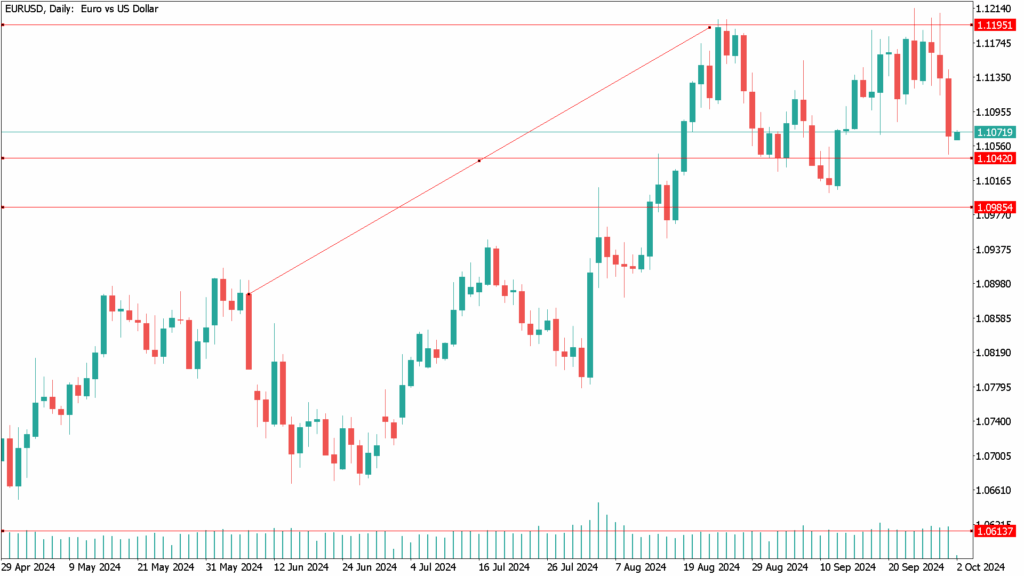

EUR/USD Daily Technical Analysis for October 2nd:

Tuesday’s decline pushed the Fib towards the 50-day exponential moving average (EMA) around 1.1045. EUR/USD recorded some late-day bids, although the pair remains firmly unbalanced, completely reversing the latest upside move towards yearly highs above 1.1200. Buyers are now on the defensive and short-term momentum is increasingly tilting to the downside. The immediate short-term target for buying pressure will be to bring the buy line back above the 1.1100 level.

A figure of 144,000 jobs is anticipated. The basic rule is that any figure slightly below that number would demonstrate the need for further Fed cuts and maintain the risk-on bias around the world and in sterling. On the other hand, a significant decline could be somewhat counterproductive, as it could signal that the economy could be slipping into recession. Consequently, if the figures offer a large upside surprise, investors will be quick to bet that the Fed will slow the pace of cuts. Therefore, it is possible that they will lower interest rates. This is likely to lead to a recovery in the dollar, which would trigger a retest of the 1.1083 technical support level.