EUR/USD Hovering Around 1.0300 Ahead of Preliminary German Inflation Data

The EUR/USD pair is retreating from last session’s gains and trading around the 1.0300 mark in Monday’s session. Traders are closely monitoring the Eurozone Composite Purchasing Managers’ Index (PMI) and the preliminary German Consumer Price Index (CPI) data, both scheduled for release today.

The pair is experiencing downward pressure as market analysts predict further declines, potentially nearing parity. This expectation is bolstered by divergent monetary policy outlooks between the Federal Reserve (Fed) and the European Central Bank (ECB).

Diverging Monetary Policies Weigh on EUR/USD

In the Eurozone, ECB policymakers are leaning toward maintaining the current pace of monetary policy easing. Markets have already factored in a 113-basis-point reduction in ECB interest rates this year, which corresponds to approximately four 25-basis-point rate cuts. These forecasts highlight growing concerns that Eurozone inflation will fall short of the ECB’s 2% target.

On Thursday, Yannis Stournaras, ECB Governing Council member and Governor of the Bank of Greece, stated in an interview with Skai Radio that the central bank’s key interest rates should drop to “around 2%” by “autumn this year.” This strongly suggests that the ECB is poised to lower its deposit facility rate at each of its next four policy meetings.

Conversely, the Fed is expected to pause its easing cycle at its January meeting following three consecutive rate cuts. According to the Fed’s Summary of Economic Projections (dot plot), policymakers anticipate the federal funds rate reaching 3.9% by the end of the year, implying just two rate cuts in 2025.

Fed officials have emphasized a more cautious stance regarding rate cuts in 2025. On Friday, Richmond Fed President Thomas Barkin underscored that benchmark interest rates would remain restrictive until there is stronger confidence that inflation is firmly on track to meet the 2% target. Similarly, Fed Governor Adriana Kugler and San Francisco Fed President Mary Daly highlighted the delicate balancing act U.S. central bankers face in slowing the pace of monetary easing this year.

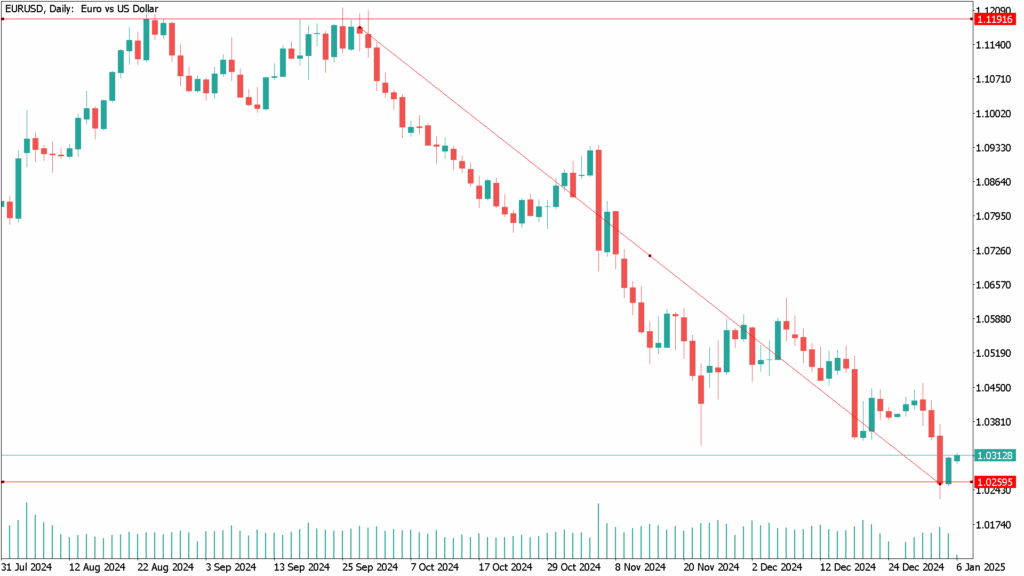

EUR/USD Daily Technical Analysis for January 6th

On the daily chart, the relative strength index (RSI) has recovered slightly above 30 after dipping near 20 on Thursday, indicating that the bearish bias remains intact despite a technical correction from oversold levels.

Key Resistance Levels:

- 1.0300: Static and psychological level serving as immediate resistance.

- 1.0350: 20-period simple moving average (SMA) and another static level.

- 1.0390–1.0400: 50-period SMA acting as a stronger resistance zone.

Key Support Levels:

- 1.0240: First static support level.

- 1.0200: Static and psychological round number.

- 1.0160: July 2022 static level providing significant support.

The technical picture suggests that the pair remains under bearish control, with limited room for upside corrections unless a clear break above key resistance levels occurs. Traders are likely to stay cautious ahead of the economic data releases and upcoming policy decisions.