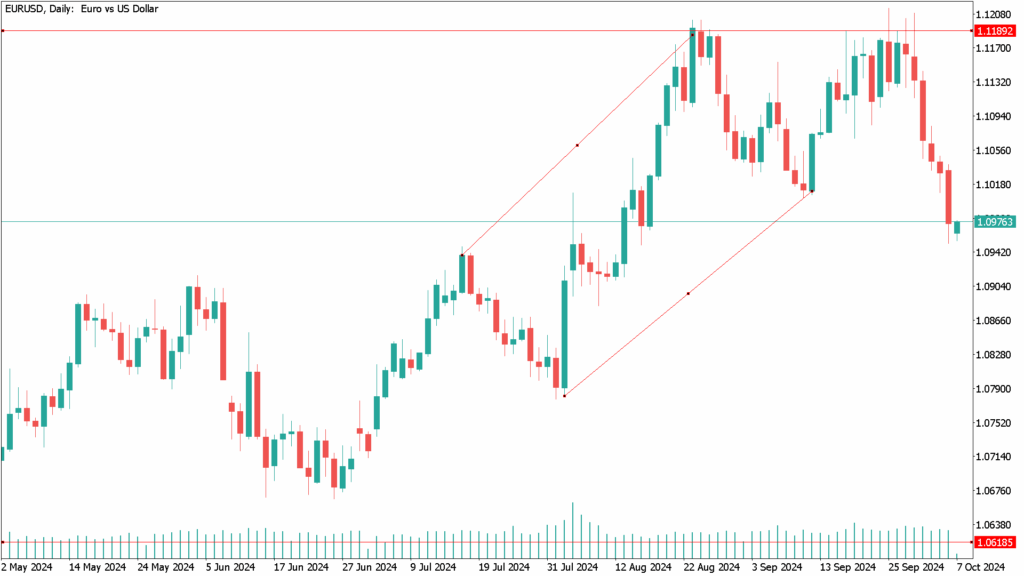

Daily Technical Analysis EUR/USD: Near Its Lowest Level Since Mid-August and Fragile at 1.0975

EUR/USD starts the week with subdued sentiment after last week’s sharp losses, bringing the pair to its lowest level since mid-August following positive U.S. jobs data on Friday. Spot prices are hovering near 1.0975 and appear vulnerable to continuing the sharp pullback from the 14-month highs around 1.1200.

The U.S. dollar is strengthening at a seven-week high as traders scaled back their expectations for any interest rate cut by the Federal Reserve in November, following stronger-than-expected U.S. jobs data. The headline NFP report revealed that 254,000 jobs were added in September, beating consensus estimates, while the unemployment rate unexpectedly dropped to 3.8%. This suggests that the labor market remains resilient, while stronger-than-expected growth in average hourly earnings has stoked inflation concerns, diminishing expectations of a more dovish stance from the Federal Reserve.

The market’s current assessment indicates a nearly 95% chance that the Fed will either keep rates unchanged or cut them by 25 basis points at its two-day policy meeting on November 7. Additionally, geopolitical risks from Middle East conflicts helped the U.S. dollar index, which compares the greenback to a basket of currencies, post its strongest weekly performance since September 2022.

Conversely, the euro remained weak amid expectations that the European Central Bank may cut rates again in October due to easing inflationary pressures and slowing economic growth.

These forecasts were reinforced by statements from François Villeroy de Galhau, a member of the ECB’s Governing Council, suggesting that the central bank could cut rates in October as weak economic growth raises the risk of inflation falling below the 2% target. This is another factor weighing on EUR/USD, increasing expectations of more short-term downside pressure. Thus, any recovery attempt could be viewed as a selling opportunity, with gains likely to fade swiftly.

EUR/USD Daily Technical Analysis for October 7th:

The EUR/USD exchange rate saw a sharp sell-off last week, and while some traders noticed minor support heading into the weekend, caution remains necessary. Friday’s slight rise may indicate a potential bullish outlook for the week ahead, but given risk-averse conditions in global markets, traders should wait for a stronger uptrend to confirm.

Technical traders believe that current support levels are crucial, and if they hold, EUR/USD could aim for the higher price levels observed last week. For EUR/USD to move higher this week, Middle East risk conditions must ease, and U.S. inflation figures need to indicate control by Thursday. For now, EUR/USD remains in a volatile and uncertain phase.