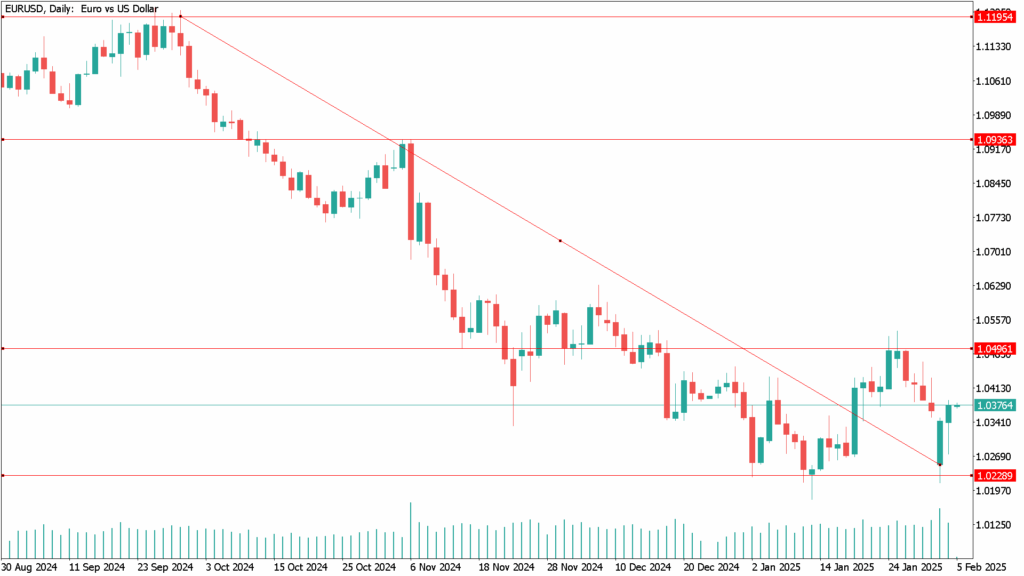

Daily Technical Analysis EUR/USD: It Recovers as Market Pressures Diminish

EUR/USD posted a modest 0.8% gain last Tuesday, attempting to recover after six consecutive days of losses. However, the pair has yet to establish itself above 1.0400. Bullish momentum remains limited, as it is still exposed to overall market sentiment and the upcoming U.S. Non-Farm Payrolls (NFP) report, which will be released at the end of the week.

Affected by Market Sentiment

The recent drop in EUR/USD to 1.0200—driven by the tariff projections from President Donald Trump and his administration—has been partially offset. The president is seeking ways to avoid implementing tariffs, recognizing that such a move would increase costs for U.S. consumers by taxing imports from other countries. Although he continues to threaten a 10% tariff on European products, he is currently negotiating compensation with almost all countries except China.

Investors believe that the president is bluffing and that his threats are increasingly losing credibility. Meanwhile, the 10% tariffs on Chinese goods remain in place, but Trump has not made a real effort to escalate them against countries that retaliate. China’s counter-tariffs, also at 10%, appear more like a symbolic gesture rather than a serious economic blow. As a result, investors are starting to overestimate the administration’s trade rhetoric, given its ongoing internal struggles.

Impact of Tariffs: Future Tariffs Will Have Less Effect

Investors are beginning to discount potential trade concessions that have not yet been announced, suggesting that keeping them undisclosed does not provide much leverage in negotiations.

Employment Expectations

The U.S. ADP employment report is scheduled for release on Wednesday, but it is not expected to significantly impact the market. Meanwhile, the ISM Services PMI report for January is set to be published and is expected to rise slightly from 54.1 to 54.3.

However, the main focus of the week is the Non-Farm Payrolls (NFP) report, which will be released on Friday. Analysts anticipate a decline in job creation, with projections falling from 256,000 to 170,000 jobs.

EUR/USD Daily Technical Analysis for February 5th

The pair has found enough momentum to halt its decline. Currently, it remains below the 1.0400 level and the 50-day Exponential Moving Average (EMA). A lack of momentum in oscillators suggests that the pair may consolidate at current levels without significant movement.

In summary, while the euro shows some signs of stabilization, its trajectory will be shaped by global trade developments and the performance of the U.S. dollar. Future economic data releases will be crucial in determining the next directional move for EUR/USD.