Daily Technical Analysis EUR/USD: Looks Up From Lows Amid CPI Data

The EUR/USD managed an intraday rally on Tuesday, climbing more than 0.8% on the day, as optimism emerged among euro buyers regarding a potential deal in France that could avert a governmental collapse. Market sentiment improved further, fueled by Fib buying after the U.S. Producer Price Index (PPI) inflation showed a much slower rise than expected. Limited economic data on the European side left EUR/USD traders navigating broader U.S. dollar flows.

U.S. PPI Data Impact

Headline PPI inflation rose to 3.3% year-over-year from 3.0% last year, while core PPI climbed to 3.5% year-over-year from 3.4%. Although both figures were below estimates, inflation pressures remain evident. As these indicators continue to exceed the Federal Reserve’s annual targets, the below-forecast PPI results offer little to bolster the likelihood of an imminent interest rate cut.

Looking ahead, Wednesday’s U.S. Consumer Price Index (CPI) data is anticipated to show a rise to 2.9% year-over-year, up from last week’s 2.7%. This figure remains well above the Fed’s 2.0% annual inflation target, potentially influencing monetary policy decisions.

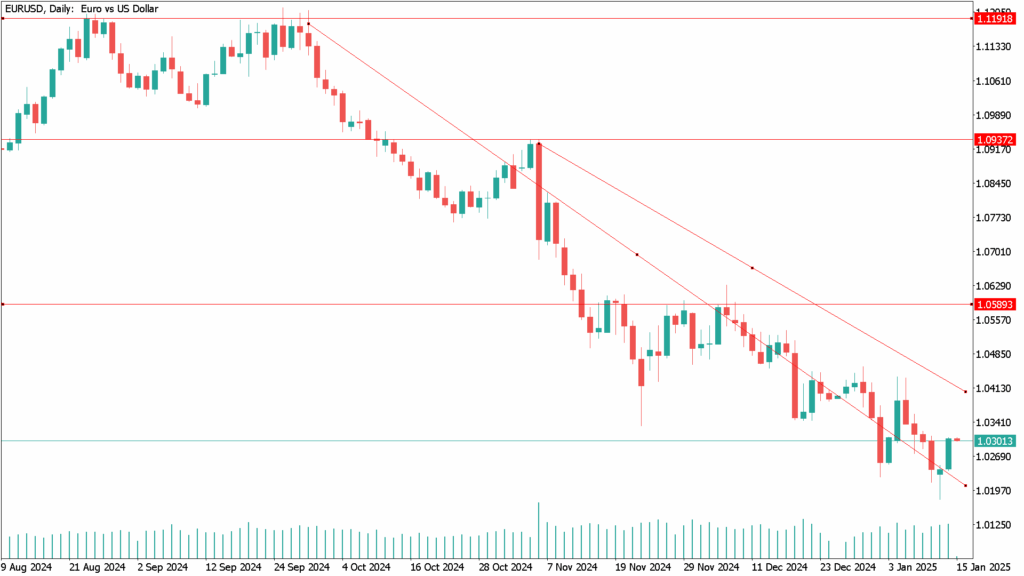

EUR/USD Daily Technical Analysis for January 15th

EUR/USD recovered the 1.0300 level on Tuesday and appears poised for a notable rally on Wednesday, although the pair continues to lean bearish on the charts. Earlier this week, the pair briefly dropped below 1.0200, hitting a fresh 265-month low.

The EUR/USD trades significantly below its 200-day exponential moving average (EMA) after a downside technical rejection from this key level in November. While the 1.0200 level could serve as a short-term technical floor for bullish momentum, prudent traders are likely to await clearer signs of a higher low as the pair gains traction in the first quarter.

As market dynamics remain sensitive to incoming inflation data and central bank policy shifts, EUR/USD’s trajectory hinges on how traders balance the interplay between European political developments and U.S. inflation metrics.