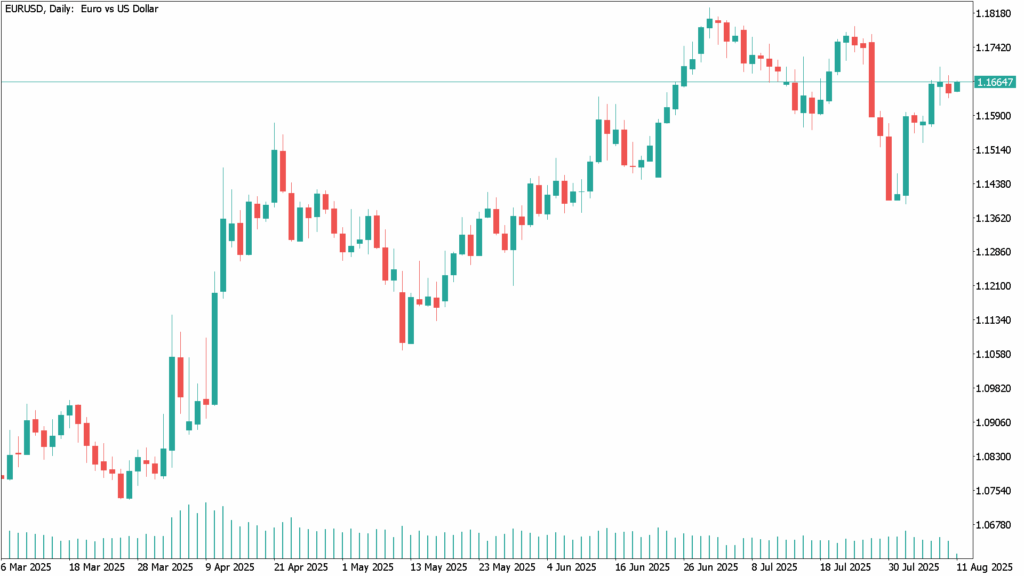

Daily Technical Analysis EUR/USD: maintaining profits in the region of 1.1650 despite the cautious tone regarding the ECB’s outlook

EUR/USD edged higher on Monday, recovering from last session’s losses to trade around 1.1650. The move was supported by renewed strength in the Euro, fueled by expectations that the European Central Bank (ECB) could pause its easing cycle in September.

Market sentiment toward the Euro also improved amid hopes that the Ukraine-Russia conflict could be nearing resolution, with reports suggesting a potential Trump-Putin meeting next week that might pave the way for a ceasefire.

On the US side, the Dollar weakened after softer economic data increased speculation over further Federal Reserve rate cuts this year. Markets are currently pricing in an 89% probability of a September rate cut and around 58 basis points of additional easing by year-end. Fed Governor Michelle Bowman reinforced these expectations, noting that three rate cuts are likely appropriate given the labor market’s recent weakness, which she views as a greater risk than persistent inflation.

EUR/USD Daily Technical Analysis – August 11

The pair’s short-term direction will likely hinge on upcoming macroeconomic data. Traders will closely watch Tuesday’s US CPI release, as it could recalibrate Fed rate expectations, followed by Thursday’s UK Q2 GDP and US Producer Price Index (PPI). Stronger-than-expected US inflation data could reignite Dollar strength and cap EUR/USD’s gains, while softer figures may extend the pair’s upward momentum.