Daily Technical Analysis EUR/USD: Pair Falls as Risk Appetite Improves While Trump’s Tariffs Fuel Uncertainty

Against the dollar, the euro is down by more than 0.30 percent heading into Tuesday’s end-of-session, weighed down by a return of positive sentiment in the market during the North American session, with the S&P 500 hitting a new record high. As of this writing, the EUR/USD pair is trading at 1.0445, below the opening price.

The Euro Falls Despite Strong Eurozone Economic Sentiment and ECB Rate Cut Expectations

US President Donald Trump’s statements continue to add uncertainty, despite the recovery in risk appetite. Trump reiterated his deadline for imposing a 25 percent tariff on car imports and predicted that major companies in the chip and auto industries would announce plans to return to the United States.

EUR/USD had regained some ground in recent weeks due to progress in peace talks between Russia and Ukraine. However, a recent high-level meeting between US and Russian officials, which excluded Ukraine, has stoked tensions. As a result, Ukrainian President Volodymyr Zelensky postponed a planned trip to Saudi Arabia from Wednesday to next month. According to an insider, the decision was made to avoid legitimizing the US-Russian discussions.

Economic Data: Robust US Indicators and Signs of Progress in the Eurozone

In the US, the Empire State Manufacturing Index from the New York Fed surprised to the upside in February, rising from -12.6 to 5.7. The index’s rebound reflects the recent recovery in the ISM Manufacturing Index, noted Oliver Allen, senior US economist at Pantheon Macroeconomics.

The US housing market, however, remained under pressure, as the NAHB index dropped from 47 to 42 due to elevated mortgage rates and weak housing supply.

In the Eurozone, the ZEW Economic Sentiment Index increased from 18 to 24.2 in February, indicating that successive rate cuts by the European Central Bank (ECB) have improved the economic outlook. At the same time, ECB member Robert Holzmann stated that a rate cut in March is possible, despite increasingly challenging conditions for further reductions, according to Bloomberg.

Wednesday’s Eurozone economic calendar is relatively quiet, while in the US, the release of the last FOMC minutes and housing starts and building permits for January will be closely watched.

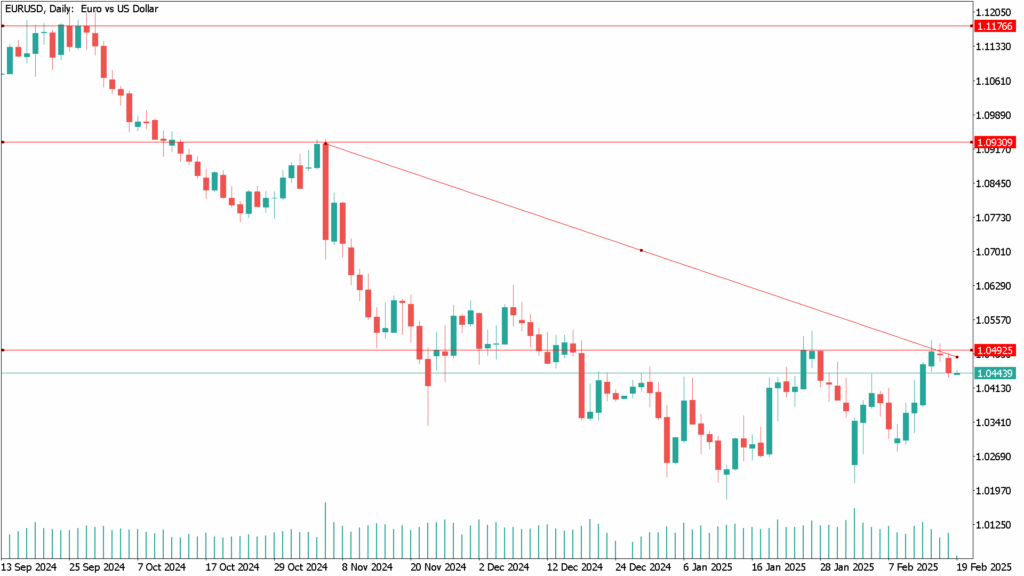

EUR/USD Daily Technical Analysis for February 19

Technically, EUR/USD is approaching a critical area around 1.0490, which has historically acted as both a support and resistance barrier, reinforcing previous reversals. A breakout to the upside could open the way for a test of 1.0600, while a downside failure may push the pair toward key support at 1.0300.

The pair is currently trading near the 9-day EMA, indicating short-term movement. However, the spot price at 1.0478 remains above the 9-day EMA at 1.0419, suggesting potential for a retracement in the short term. The difference between the two levels implies that a drop back to 1.0419 could serve as a better turning point before the next directional move.