Daily Technical Analysis: EUR/USD Rises Above 1.0400 Ahead of European Inflation Indicators

The EUR/USD pair experienced a strong rebound on Tuesday, gaining 1.4% and adding 140 pips in a single session. The decline of the U.S. dollar fueled the euro’s rise as markets speculated on the possibility that President Donald Trump might reconsider his tariff threats.

Trade War Takes Center Stage

In line with his unpredictable style, Trump may be preparing to shift his stance on the recently imposed tariffs. Despite the 25% tariff package on imports from Canada and Mexico taking effect at midnight (EST), markets reacted optimistically to the possibility of a reversal. U.S. Commerce Secretary Howard Lutnick hinted in an interview with Fox News that the president could announce changes on Wednesday.

Meanwhile, investors are bracing for key economic releases this week, including the European Central Bank’s (ECB) interest rate decision on Thursday and the U.S. non-farm payrolls (NFP) report on Friday.

Key Data in the U.S. and Europe

On Wednesday, the ADP employment report is expected to show a decline from 183K to 140K, while the ISM services index is forecast to edge lower from 52.8 to 52.6.

In Europe, the ECB is widely expected to cut interest rates by 25 basis points, lowering the main reference rate to 2.65% and the deposit rate to 2.5%. The central bank aims to mitigate recession risks and bolster economic growth.

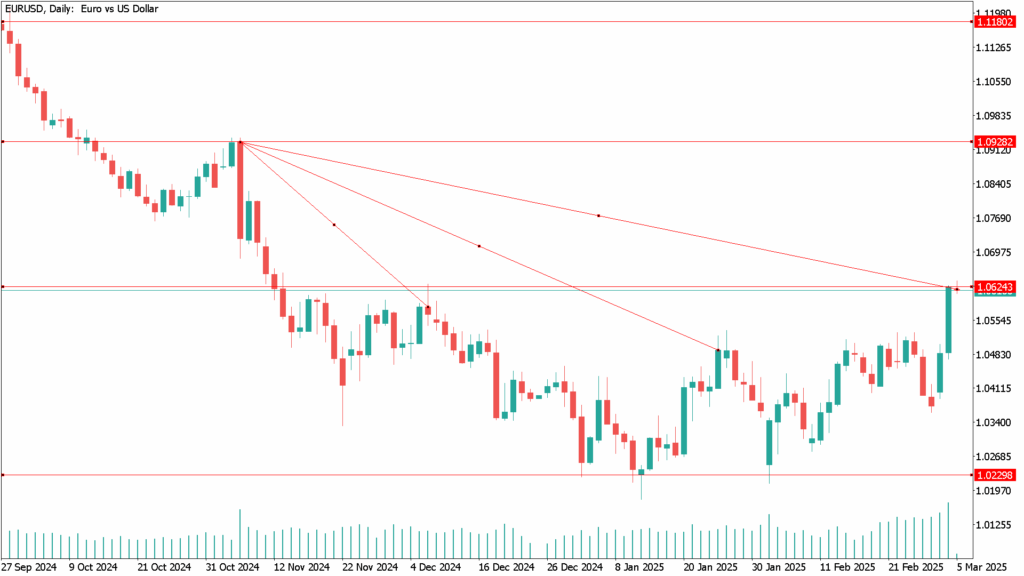

EUR/USD Daily Technical Analysis for March 5th

The euro recorded its best daily performance in over two years, breaking above the 1.0600 resistance level for the first time since December. If this momentum continues, the pair could target five-month highs.

However, technical obstacles remain. The 200-day exponential moving average (EMA), positioned near 1.0635, could slow the upward movement. Additionally, technical indicators suggest the pair is in overbought territory, which may trigger a downward correction.

Despite these hurdles, the overall sentiment remains bullish as the market awaits key economic data that could determine the pair’s next move.