Daily Technical Analysis EUR/USD: Rallies on Wednesday as the U.S. Dollar Continues to Weaken

EUR/USD climbed on Wednesday, recovering most of its early-week losses as the pair moved closer to the 1.1200 mark. The rebound was driven more by broad-based U.S. dollar softness than by any strong bullish sentiment specific to the euro.

Muted Market Reaction to U.S. CPI Data

Tuesday’s release of U.S. Consumer Price Index (CPI) inflation data prompted a relatively muted reaction from markets. Investors remain cautiously optimistic that ongoing trade negotiations led by the Trump administration will help maintain a positive tone, although any tariff rollbacks so far have been temporary and subject to reversal.

April’s CPI report showed a modest decline, pushing annualized headline inflation to a new three-year low. However, with the Trump administration’s aggressive tariff stance—including triple-digit duties on key trade partners—analysts expect inflationary pressures to pick up again, potentially making this one of the last soft CPI prints in the near term.

Upcoming Data in Focus

Germany: Final readings of the Harmonized Index of Consumer Prices (HICP) will be released on Wednesday. However, as non-preliminary data, the figures are unlikely to spark much market movement.

Eurozone: First-quarter GDP results are due Thursday, with markets expecting a similar outcome to the previous quarter.

United States:

- Thursday: Producer Price Index (PPI) inflation figures

- Friday: University of Michigan Consumer Sentiment Index, a key gauge of consumer confidence and inflation expectations

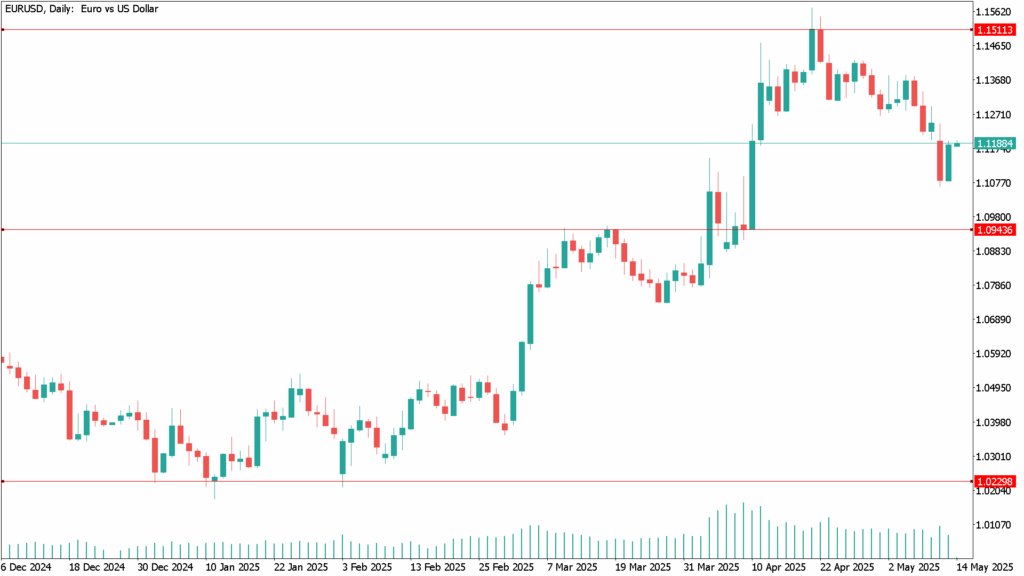

EUR/USD Daily Technical Analysis for May 14th

EUR/USD made a strong push toward the 1.1200 level but fell just short of breaking through this critical resistance zone. Still, the pair managed to climb back above the 50-day Exponential Moving Average (EMA) near 1.1070—an encouraging technical signal.

Although daily candlesticks show limited bullish momentum, technical indicators are beginning to reverse from oversold levels, suggesting the potential for a continuation of the upward move if bullish sentiment gains traction.els, suggesting the potential for a continuation of the upward move if bullish sentiment gains traction.