Daily Technical Analysis: EUR/USD Holds Above 1.0850 Amid US Growth Uncertainty

EUR/USD kicked off the week on a positive note, trading near 1.0860. The pair’s upward momentum is fueled by growing concerns over a potential slowdown in the US economy. On Sunday, San Francisco Fed President Mary Daly noted that rising uncertainty among businesses could weaken demand but does not warrant an immediate change in interest rates.

US Labor Market Weakens, Weighing on the Dollar

On Friday, data from the US Bureau of Labor Statistics (BLS) showed that Nonfarm Payrolls (NFP) increased by 151,000 in February, missing the forecast of 160,000. January’s job growth was also revised lower to 125,000 from the previously reported 143,000. This weaker-than-expected labor market data could put pressure on the US Dollar (USD), supporting EUR/USD.

Trade Policy Uncertainty and Market Sentiment

Meanwhile, US Commerce Secretary Howard Lutnick stated on Sunday that the 25% tariffs on steel and aluminum imports—imposed by President Donald Trump in February—are set to take effect on Wednesday, with no delays expected, according to Bloomberg. While US steel producers back the tariffs, businesses dependent on these materials may face rising costs, which could weigh on market sentiment. This dynamic could provide some support to the US Dollar, potentially limiting EUR/USD’s upside.

Euro Gains Support from Germany’s Fiscal Reforms

The Euro (EUR) found additional strength as Germany’s major political parties announced plans to revise the debt brake, aiming to boost defense spending and launch a €500 billion infrastructure initiative to stimulate economic growth. Additionally, European leaders agreed on a substantial increase in defense spending to enhance the continent’s military capabilities.

ECB Policy Outlook

On the monetary policy front, the European Central Bank (ECB) delivered a widely expected 25 basis points (bps) rate cut and acknowledged that monetary policy is becoming less restrictive. The statement hinted at a potential pause in further rate reductions, though market participants still anticipate one or two additional 25 bps cuts later this year.

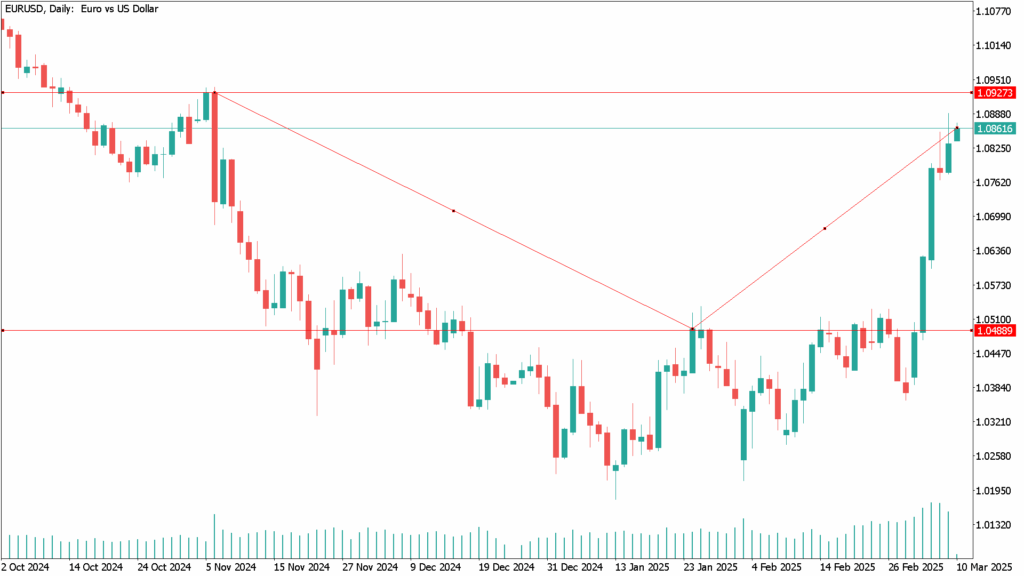

EUR/USD Daily Technical Analysis for March 10th

The daily chart indicates that EUR/USD is extremely overbought, yet technical indicators continue to point upward, suggesting that the recovery may extend before a significant corrective pullback. The pair has also surpassed all its moving averages, with the 20 SMA turning north below the longer-term ones. The 200 SMA now acts as dynamic support around 1.0725.

The 1.0800 level serves as immediate support, followed by the 200-day SMA at 1.0725 and the December peak at 1.0629. On the upside, a break above 1.0890 could open the door to the 1.1000 psychological level, with further gains potentially testing 1.1080 and the September 2024 high at 1.1213.