Daily Technical Analysis EUR/USD: remains stable at close to 1.1570 as markets assimilate the Fed’s forecasts

The EUR/USD remained stable around 1.1573 on Wednesday as traders assessed the latest US employment figures and awaited additional economic releases. Mixed HCOB Flash PMI readings from the Eurozone failed to lift the Euro against the Dollar.

During the session, reports surfaced that President Donald Trump considered nominating Treasury Secretary Scott Bessent to fill the vacant Federal Reserve seat following Adriana Kugler’s upcoming resignation on August 8. However, Bessent declined to be considered.

On the data front, ISM Services PMI slipped to 50.1 in July from 50.8, missing expectations for 51.6 and signaling stagnation in service activity. Earlier, the US trade deficit narrowed to a nearly two-year low of $60.2 billion in June, better than forecasts, while China’s trade gap hit its smallest level in over two decades.

Despite these figures, EUR/USD traded within a tight range as results aligned broadly with estimates. In Europe, the bloc’s Services PMI eased to 51 from 51.2, with France contracting to 48.5 and Italy inching up to 52.3, both missing forecasts. Spain and Germany showed modest improvement but failed to shift market sentiment.

Looking ahead, attention turns to remarks from Fed officials, including Susan Collins, Lisa Cook, and Mary Daly. In the Eurozone, German Factory Orders and EU Retail Sales will provide further economic cues.

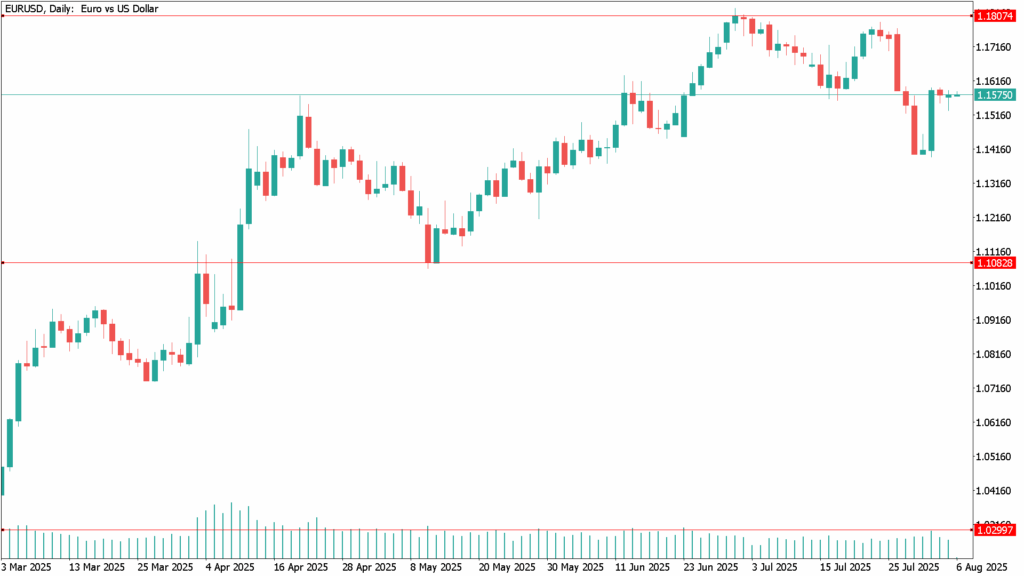

EUR/USD Daily Technical Analysis – August 6

EUR/USD remains capped below 1.1600, with momentum subdued. A break above this level could target the 20-day SMA at 1.1630 and resistance at 1.1650 and 1.1700. On the downside, a drop below the 50-day SMA at 1.1576 would expose 1.1550, with further losses toward 1.1500 and August’s low of 1.1391.