EUR/USD Stays Tepid Near 1.0700 Amid Rising Dollar and Political Uncertainty

The EUR/USD pair remains under significant pressure, primarily driven by the strengthening U.S. dollar and escalating political uncertainty in Germany. The prospect of Donald Trump’s return to the White House has raised expectations of higher U.S. tariffs and lower corporate taxes, policies that could elevate inflation risks and push the Federal Reserve toward a more hawkish stance.

Impact of Trump’s Fiscal Policies

Trump’s proposed fiscal policies, such as increased import tariffs and corporate tax reductions, are expected to stimulate investment, spending, and labor demand. Analysts suggest that such policies could lead to higher inflation, forcing the Federal Reserve to adopt a more restrictive monetary policy. A tighter Fed stance would likely bolster the U.S. dollar, exerting further downward pressure on EUR/USD.

Despite these projections, Fed Chairman Jerome Powell recently stated that Trump’s presidency would not influence the Federal Reserve’s policy decisions immediately. Powell emphasized the Fed’s data-driven approach, noting after a 25 basis-point rate cut last Thursday, “We don’t guess, speculate, or assume what the government’s future policy decisions will be.” The rate cut places the Fed’s benchmark interest rate in the 4.50%–4.75% range.

The University of Michigan’s Consumer Sentiment Index rose to 73.0 in November, up from 70.5 in October, surpassing market expectations of 71.0. This improvement reflects robust consumer confidence, further strengthening the dollar.

Political Instability in Germany

In Germany, political turmoil continues as Chancellor Olaf Scholz dissolved the ruling coalition, dismissed the Finance Minister, and appointed a new one. These developments have heightened calls for early elections to restore stability, adding to the euro’s struggles.

Analysts at Deutsche Bank highlight that potential U.S. tariffs could harm the eurozone’s export sector, compounding economic uncertainty. They note, “Uncertainty is high on many levels, from the exact impact of U.S. tariffs to the timing of their implementation, to how and when Europe responds.”

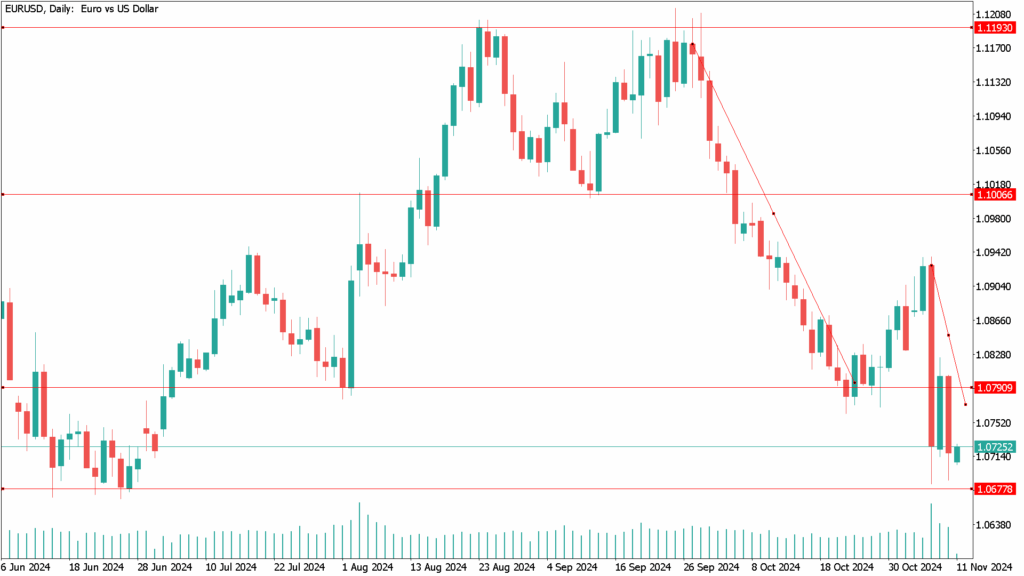

EUR/USD Daily Technical Analysis for November 11th:

From a technical perspective, the EUR/USD trades approximately 200 pips below its November high of 1.0936, with technical readings indicating a bearish outlook. On the weekly chart, the pair is pressured by a flat 20 simple moving average, while the 100 SMA remains directionless. The 200 SMA shows growing bearish momentum, reinforcing the negative sentiment. Indicators on the chart are pointing decisively downward, suggesting the potential for further declines.

The daily chart confirms this bearish trend, with the pair unwinding below all moving averages. The 20 SMA has a pronounced downward slope, offering resistance around 1.0830. Indicators on the daily chart are consolidating below their midlines, adding to the bearish sentiment.

Support levels are observed at the weekly low of 1.0681, with the year’s low of 1.0600 serving as a critical barrier. A break below this level is considered unlikely but could lead to further declines toward the 1.0530/40 price zone if it occurs. Resistance levels are seen in the 1.0800–1.0830 range, followed by 1.0900.

In summary, the EUR/USD remains under significant pressure due to a strengthening dollar and heightened political uncertainty in Germany. While immediate support and resistance levels provide some guidance, the pair’s trajectory is heavily dependent on fundamental developments, particularly regarding U.S. fiscal policies and eurozone economic stability. For now, the outlook remains bearish, with sellers maintaining control.