Daily Technical Analysis EUR/USD: Rises Ahead of Weak Dollar, with Key Technical Barriers Still in Place

EUR/USD gained for a second consecutive session on Tuesday, lifting the pair closer to the 1.1300 mark. While bullish momentum has returned in the near term, the euro remains well below the multi-year highs near 1.1575. Strong support from key moving averages has provided a technical floor, and market sentiment remains cautiously optimistic that traders will continue to find reasons to stay on the buy side.

Market attention remains fixated on trade developments, particularly from the U.S., while headlines from Europe remain limited with EU policymakers tied up in G7 meetings. Investors are hopeful that ongoing negotiations with the Trump administration may ease trade tensions and pull back the threat of further tariffs. However, the lack of concrete agreements and the looming expiration of the U.S.’s self-imposed 90-day tariff deadline are tempering market enthusiasm.

Looking ahead, Wednesday offers a light economic calendar, with only second-tier data releases from both sides of the Atlantic. More attention will turn to Thursday’s U.S. PMI figures. Expectations point to a slight dip in Manufacturing PMI to 50.1 from 50.2, while the Services PMI is projected to remain steady at 50.8.

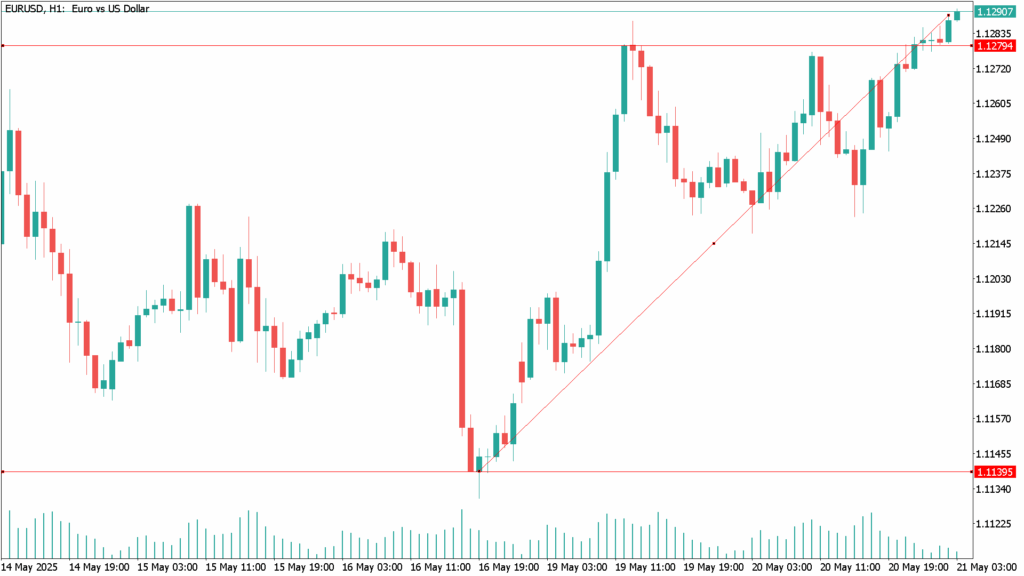

EUR/USD Daily Technical Analysis for May 21st

The euro advanced 0.4% against the U.S. dollar on Tuesday, with EUR/USD nearing the psychological 1.1300 barrier. The pair continues its steady rebound from the 50-day Exponential Moving Average (EMA) just below 1.1100. Despite the upward momentum, bulls still face a significant challenge in reclaiming ground toward the multi-year highs above 1.1575.