Daily Technical Analysis: EUR/USD Rises to 1.1700 on Weak US CPI and Growing Fed Rate Cut Speculation

The EUR/USD advanced during Tuesday’s session, supported by mixed US inflation data and comments from President Donald Trump targeting Federal Reserve Chair Jerome Powell. At the time of writing, the pair trades 0.50% higher at 1.1673.

Market sentiment remained constructive, with US equities gaining after the latest Consumer Price Index (CPI) release. Headline inflation was unchanged, while core inflation exceeded forecasts. Despite this, traders largely maintained their expectations—above 90%—for a Federal Reserve rate cut in September. Trump criticized Powell for being “too late” to lower rates and went as far as to threaten legal action over renovations to the Fed’s headquarters.

Fed commentary was mixed. Kansas City Fed President Jeffrey Schmid struck a hawkish tone, Richmond Fed President Thomas Barkin maintained a neutral stance, and Trump’s Fed Board nominee Stephen Miran stressed the importance of Fed independence ahead of his Senate confirmation.

In Europe, the August ZEW Survey reflected a sharp deterioration in sentiment. EU expectations fell from 36.1 to 25.1, while Germany’s reading dropped from 52.7 to 34.7—missing market estimates. Analysts attributed the decline to weak Q2 output and disappointment over the recently concluded US trade deal.

Looking ahead, Wednesday’s calendar is busy. In the US, Fed Presidents Barkin, Goolsbee, and Bostic are scheduled to speak, while Europe will see the release of German and Spanish CPI data.

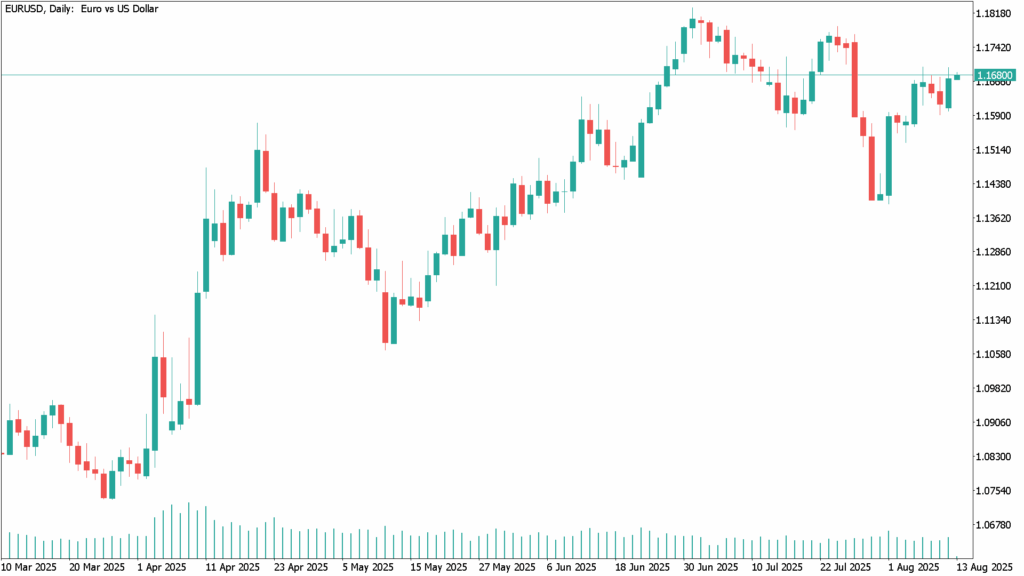

EUR/USD Daily Technical Analysis – August 13

The EUR/USD rally stalled near 1.1700 after overcoming resistance at 1.1650. RSI momentum continues to favor buyers, though a short-term pullback remains possible. A decline below 1.1650 could trigger a move toward the 20-day and 50-day SMAs near 1.1626/1.1619, followed by the 1.1600 support level. On the upside, a sustained break above 1.1700 would pave the way for further gains toward 1.1750, 1.1800, and the year-to-date high at 1.1829.