Daily Technical Analysis EUR/USD : Rises Toward 1.1400 After Tariff Delay

EUR/USD continues its upward momentum for the second straight session, trading near 1.1390 on Monday. The euro is gaining strength after Bloomberg reported that former U.S. President Donald Trump agreed to postpone the implementation of a 50% tariff on European Union (EU) imports until July 9.

On Sunday, European Commission President Ursula von der Leyen stated on social media that the EU is ready to advance trade negotiations with the U.S. but needs additional time to finalize a deal. Meanwhile, U.S. markets are closed for the Memorial Day holiday.

The move follows Trump’s threat on Friday to impose 50% tariffs starting June 1, 2025, claiming on Truth Social that Brussels had presented a poor trade proposal and that negotiations were “going nowhere.”

Dollar Weakness and Fiscal Concerns Boost EUR/USD

The EUR/USD pair is also benefiting from continued weakness in the U.S. dollar, driven by rising concerns over the U.S. economic outlook. Market sentiment remains under pressure as Trump’s proposed “One Big Beautiful Bill” could further widen the fiscal deficit, potentially keeping bond yields elevated for an extended period—raising borrowing costs across the board.

Adding to the uncertainty, Moody’s recently downgraded the U.S. credit rating from Aaa to Aa1, citing a deteriorating debt outlook. The agency now expects U.S. federal debt to rise from 98% of GDP in 2023 to about 134% by 2035, with the budget deficit projected to reach nearly 9% of GDP.

Federal Reserve officials remain cautious amid these developments. On Friday, Chicago Fed President Austan Goolsbee indicated that Trump’s tariff threats could delay any changes to interest rates. Kansas City Fed President Jeffrey Schmid emphasized the need to rely on hard economic data over soft indicators when making monetary policy decisions.

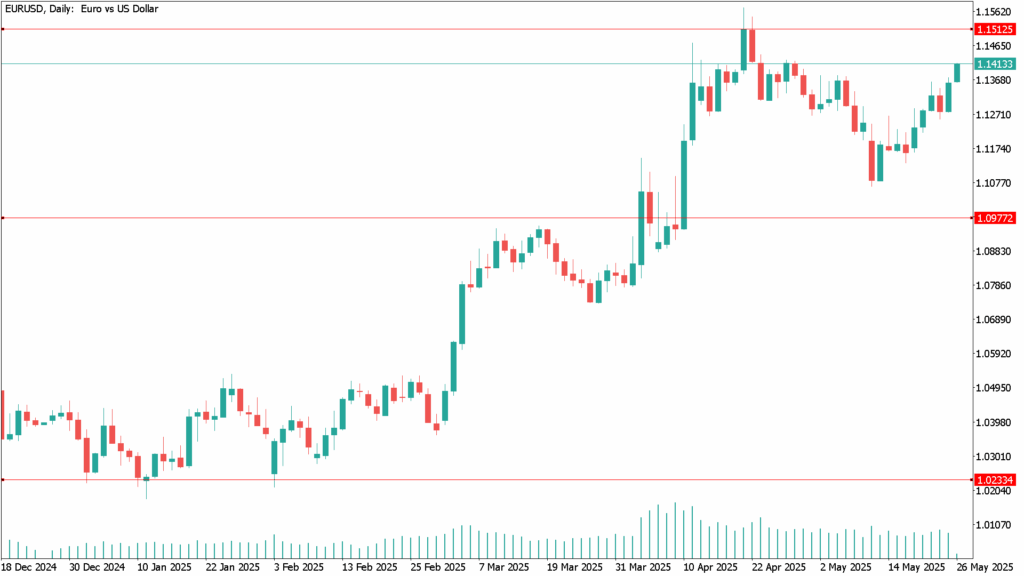

EUR/USD Daily Technical Analysis for May 26th

Technically, the EUR/USD outlook is neutral-to-bullish. The pair has broken above a flat 20-day Simple Moving Average (SMA) near 1.1270, which has drawn buyers for three consecutive sessions. Meanwhile, the 100-day SMA is approaching a bullish crossover with the 200-day SMA, suggesting continued upside potential.

Momentum remains steady near its midline, while the Relative Strength Index (RSI) is pointing north at around 57, indicating renewed buying interest.

A break above last week’s high would open the door toward the 1.1460 resistance zone, with the yearly high at 1.1573 as the next key target. On the downside, a drop below 1.1270 could see the pair decline toward 1.1160, followed by stronger support at May’s low of 1.1064.