EUR/USD Rises to Near 1.0450 on Increased Prospects

The EUR/USD pair is trading near 1.0430 on Monday, holding flat after Friday’s gains. The pair’s rise is attributed to a weakening U.S. dollar following the release of the U.S. Personal Consumption Expenditure (PCE) Price Index data.

The November inflation report revealed that year-on-year core PCE inflation, the Federal Reserve’s preferred measure of inflation, rose by 2.8%, slightly below expectations of 2.9%. Monthly core inflation rose by 0.1%, compared to estimates of 0.2% and the previous year’s reading of 0.3%.

The lower-than-expected U.S. inflation data has reinforced market sentiment that the Federal Reserve will slow the pace of further rate cuts in the coming year. According to CME’s FedWatch tool, markets now see a more than 90% probability that the Fed will leave interest rates unchanged in January, maintaining the current range of 4.25%-4.50%.

U.S. Political Developments

On Sunday, President-elect Donald Trump announced key appointments to his administration, as reported by Business Insider. Notable appointments include Jacob Helberg, a senior advisor to Palantir CEO Alex Karp, as Secretary of State for Economic Growth, Energy, and the Environment, Scott Bessent as Secretary of the Treasury, Howard Lutnick as Secretary of Commerce, Kevin Hassett as Chairman of the National Economic Council. Andrew Ferguson as Chairman of the Federal Trade Commission.

European Economic Developments

In the eurozone, Boris Vujčić, a member of the European Central Bank’s Governing Council, stated over the weekend that the ECB plans to continue reducing borrowing costs through 2025, according to Bloomberg. “The direction is clear: it is a continuation of the 2024 path, with further interest rate cuts,” he said.

Germany’s approval of fiscal reforms also provided a boost to the euro. These reforms aim to increase household disposable income, thereby stimulating consumer demand and driving economic growth. As the largest economy in the eurozone, Germany’s fiscal actions have significant implications for the region.

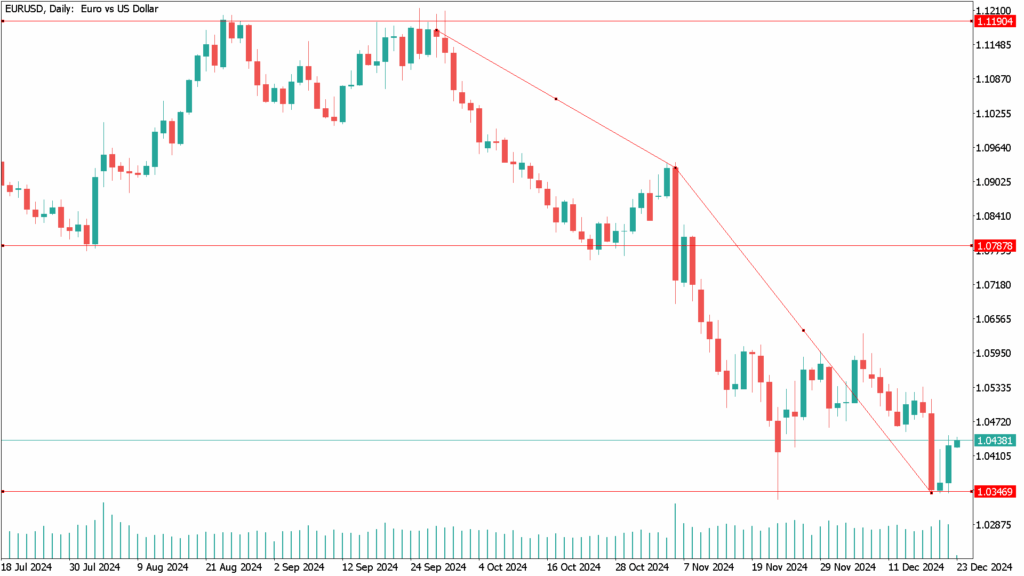

EUR/USD Daily Technical Analysis for December 23rd

Despite modest improvements, the pair remains below the 20-day Simple Moving Average (SMA), which continues to act as a barrier to upside momentum and warrants caution.

Key Technical Indicators

- Relative Strength Index (RSI): The RSI has risen to 37, still in the bearish zone but signaling a gradual reduction in selling pressure.

- MACD (Moving Average Convergence Divergence): The MACD histogram displays flat red bars, indicating persistent weakness, though there are tentative signs of stabilization.

While selling pressures are easing, the overall bias for EUR/USD remains bearish. A sustained move above the 20-day SMA is required to confirm a reversal in sentiment and open the door for further gains. On the downside, a failure to hold above the 1.0400 level could invite renewed selling pressure, potentially exposing the pair to yearly lows.