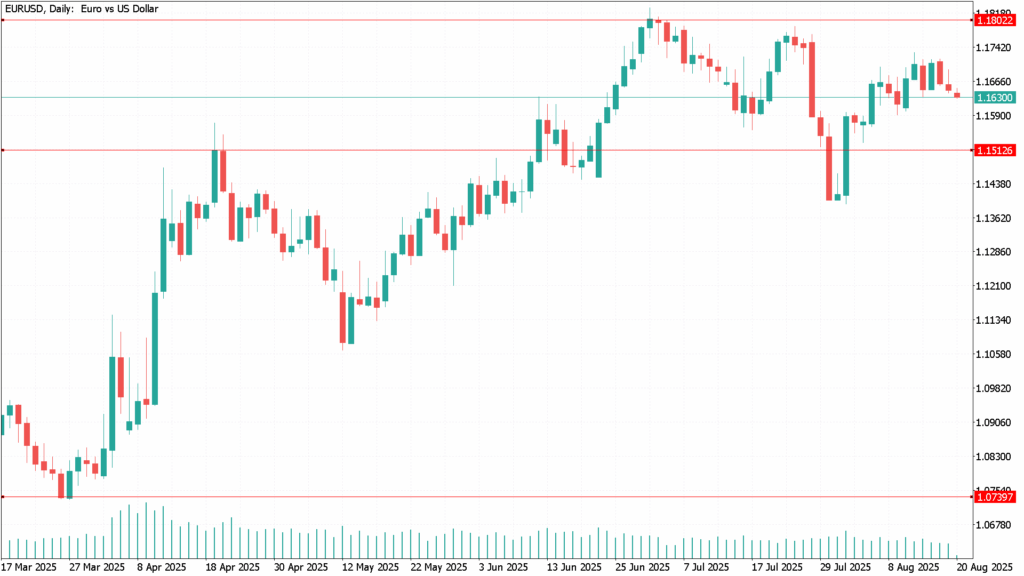

Daily Technical Analysis EUR/USD: Stabilizes Under 1.1650 as Markets Anticipate Powell’s Speech in Jackson Hole

EUR/USD is consolidating above the 1.1600 level, trading near 1.1640 and down 0.12% as markets await Federal Reserve Chair Jerome Powell’s speech at Jackson Hole and monitor developments in the Ukraine-Russia conflict.

In the U.S., housing data released Tuesday had little impact, with investors focused instead on last week’s inflation reports. CPI figures initially fueled speculation of a 50 bps rate cut, following commentary from Bessent on Fox Business. However, stronger-than-expected PPI data shifted expectations toward a smaller 25 bps cut, with some participants betting the Fed could keep rates unchanged. Powell’s remarks on Friday will be key in shaping the policy outlook for the second half of 2025.

On the geopolitical front, prospects of a resolution in Eastern Europe could lend support to the Euro, with President Trump pressing for direct talks between Ukrainian President Volodymyr Zelenskiy and Russian President Vladimir Putin. In the Eurozone, a light data calendar leaves traders looking ahead to inflation releases, August HCOB Flash PMIs, and Germany’s GDP figures.

Market Drivers: EUR/USD Under Pressure as Dollar Strengthens

The U.S. Dollar’s rebound is weighing on the Euro, with the DXY up 0.14% at 98.27. Sentiment continues to be driven by safe-haven flows and policy divergence between the Fed and the ECB. Markets are pricing in an 86% chance of a Fed rate cut in September, while the ECB is expected to hold steady with a 92% probability of no change and only an 8% chance of a 25 bps cut.

U.S. housing indicators were mixed in July: Housing Starts rose 5.2% to 1.428 million, beating forecasts, while Building Permits fell to 1.354 million, suggesting potential softness ahead in residential construction.

EUR/USD Daily Technical Analysis – August 20

EUR/USD has retreated toward 1.1646 over the last three sessions, signaling fading bullish momentum. The RSI remains positive but is nearing neutral territory, pointing to growing downside risk.

If the pair regains 1.1700, resistance lies at 1.1788 (July 24 high), 1.1800 (psychological level), and 1.1829 (year-to-date peak). On the downside, a break below the 20- and 50-day SMAs around 1.1639/27 could open the door to 1.1600, followed by the 100-day SMA at 1.1460.