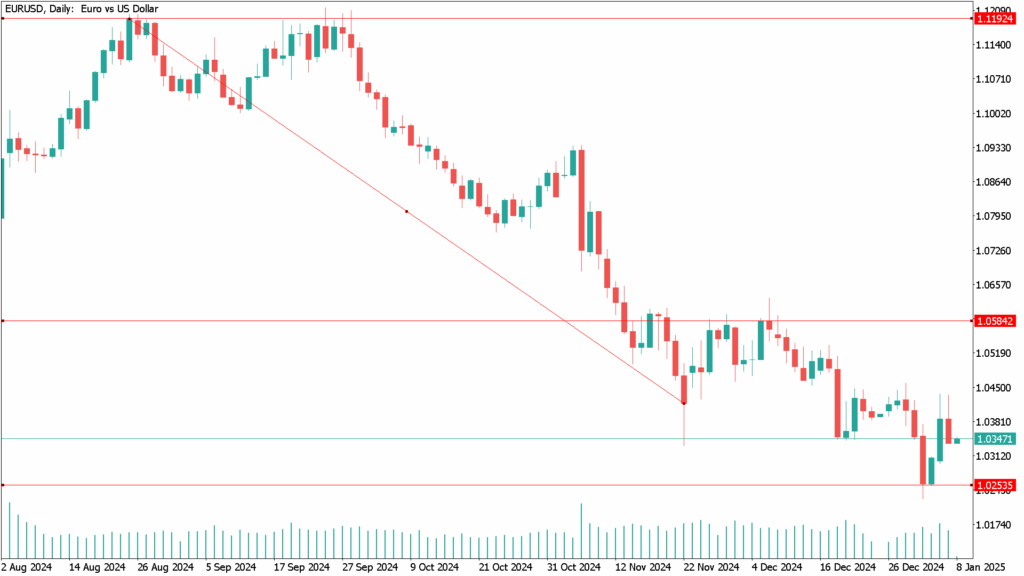

Daily Technical Analysis EUR/USD: Pair Declines Again, Remains Distant From Key Technical Levels

The EUR/USD pair dropped on Tuesday, losing nearly four-tenths of a percentage point after a failed recovery attempt to breach the 1.0400 level. The pair continues to trade just above the 26-month lows reached last week, though the rebound remains modest.

Euro bulls face increasing urgency for a reversal as the Fib retracement levels indicate potential movement toward the 1.0200 mark.

Inflation Data Fails to Provide Support for the Euro

The Eurozone’s Harmonized Index of Consumer Prices (HICP) inflation came in near expectations, with the annualized HICP for the year ending in December rising slightly to 2.4% y/y from the prior 2.2%. However, most of the upward pressure in these inflation figures seems to stem from previous inputs or non-structural factors, providing traders with some optimism that underlying conditions may not worsen significantly.

Stronger U.S. Data Challenges Rate-Cut Expectations

In the U.S., better-than-expected ISM services PMI and services prices paid figures for December have raised concerns that the Federal Reserve may not cut interest rates as aggressively in 2025 as markets had anticipated. These strong numbers hint at sustained economic resilience, which could complicate the Fed’s path to easing monetary policy.

Key Economic Indicators to Watch

Upcoming data releases include German retail sales and the European Union Producer Price Index (PPI), both of which are projected to show strong rebounds. Across the Atlantic, U.S. ADP employment figures will serve as a precursor to Friday’s non-farm payrolls report. While traders might treat ADP data cautiously, significant deviations from forecasts could spark sharp market reactions. Investors will also closely monitor any indications of potential rate cuts before June, as these would imply a softer, though not critically weak, U.S. labor market.

EUR/USD Daily Technical Analysis for January 8th

The EUR/USD pair remains under pressure as the U.S. dollar continues to dominate as the market’s safe-haven currency. The pair has declined over 6.5% since peaking just above 1.0900 in early November, a level that coincided with a clear technical rejection at the 200-day Exponential Moving Average (EMA). The 200-day EMA has since descended to the 1.0700 level, acting as a formidable resistance point.

For euro bulls aiming to establish a sustainable upward trajectory from multi-year lows, the first challenge will be overcoming the 50-day EMA, which is currently trending downward toward the 1.0500 mark. A breach above this level would be necessary to build momentum, but until then, bearish sentiment continues to dominate.