Daily Technical Analysis EUR/USD: The Pair Trades Around 1.1350 After Two Days of Gains

The EUR/USD pair edged lower during Monday’s trading, hovering near 1.1360 after two days of gains. The recent uptick was largely fueled by broad-based U.S. Dollar (USD) weakness, as mounting trade tensions between the U.S. and China reignited fears of a global economic slowdown.

On Friday, China’s Ministry of Finance announced a steep increase in tariffs on U.S. imports, raising duties from 84% to 125%. The move came in response to President Donald Trump’s decision a day earlier to hike tariffs on Chinese goods to 145%. In a bid to ease trade friction, the European Union (EU) announced a 90-day suspension of its planned retaliatory tariffs, mirroring Washington’s own pause to encourage renewed trade negotiations.

Speaking to Handelsblatt over the weekend, Germany’s Chancellor-in-waiting Friedrich Merz criticized the Trump administration’s economic policies, warning that “President Trump’s policies are increasing the risk that the next financial crisis will hit sooner than expected.” Merz also called for a new transatlantic trade agreement, proposing “zero percent tariffs on everything” as a mutually beneficial solution.

The U.S. Dollar Index (DXY), which tracks the greenback against a basket of six major currencies, extended its decline for a third straight session, slipping below the 100.00 mark and approaching Friday’s three-year low. The ongoing drop reflects waning investor confidence amid weak economic data and dovish rhetoric from central bankers.

Recent U.S. data offered a mixed picture. The University of Michigan’s consumer sentiment index fell to 50.8 in April, while one-year inflation expectations climbed to 6.7%. March’s Producer Price Index (PPI) eased to a 2.7% annual rate, down from 3.2% in February, with the core rate slowing to 3.3%. Meanwhile, initial jobless claims rose slightly to 223,000, but continuing claims fell to 1.85 million, underscoring ongoing labor market uncertainty.

On Sunday, Minneapolis Federal Reserve President Neel Kashkari told Face the Nation that the economic impact of the Trump-led trade war will depend largely on how quickly uncertainties are resolved. “This is the biggest hit to confidence that I can recall in the 10 years I’ve been at the Fed—aside from March 2020 when COVID first hit,” Kashkari noted.

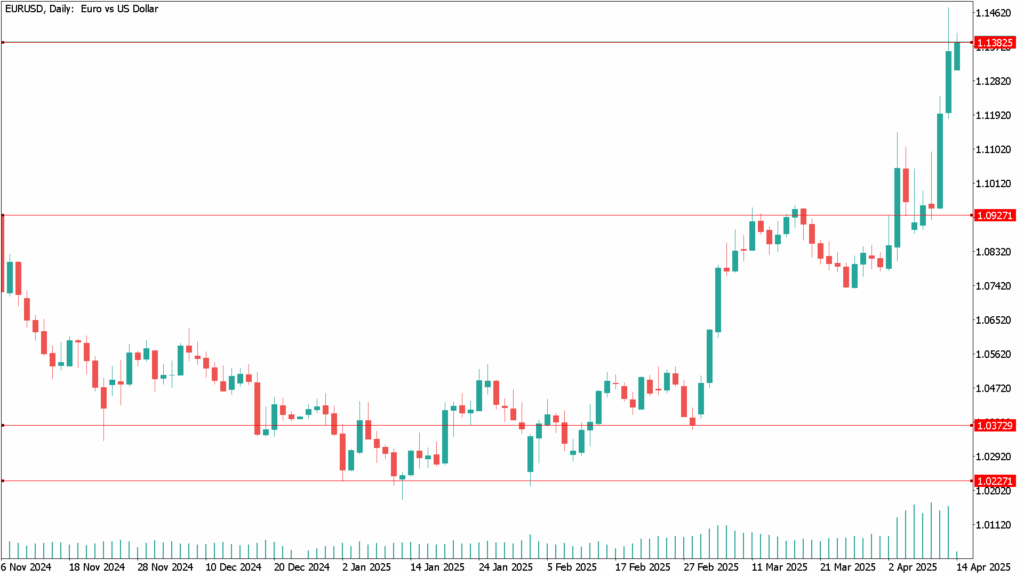

EUR/USD Daily Technical Analysis for April 14th

Despite Monday’s pullback, the technical outlook for EUR/USD remains bullish. The pair is trading well above all key moving averages, with the 20-day SMA accelerating upward near 1.0910 and staying far above the flat 100- and 200-day SMAs. While the daily chart shows overbought conditions, indicators suggest momentum remains strong.

The Momentum oscillator continues climbing in extreme territory, and the Relative Strength Index (RSI) holds near 76, signaling persistent buying interest.

Should EUR/USD break above the 1.1470 resistance zone, the next targets lie in the 1.1540–1.1560 region, followed by the key 1.1600 handle. On the downside, initial support is expected around the former 2025 high near 1.1240, with further support at 1.1160 if selling pressure increases.