Daily Technical Analysis EUR/USD: Holds Above 1.0900 Amid Trade Tensions

Despite USD weakness, traders remain cautious about aggressively buying the euro due to rising trade tensions between the U.S. and the European Union (EU). The EU faces 25% tariffs on steel, aluminum, and cars, with reciprocal duties of 20% on most other goods. In response, the European Commission is set to announce a list of U.S. products targeted for additional tariffs. These developments could bolster demand for the safe-haven USD, potentially capping further gains in EUR/USD.

Key Data and Market Drivers

Traders will closely monitor upcoming economic releases, including:

- German Industrial Production & Trade Balance Data

- Eurozone Sentix Investor Confidence Index

However, the primary market focus will remain on trade-related developments, which could shape broader risk sentiment and impact USD demand, influencing short-term price action in EUR/USD.

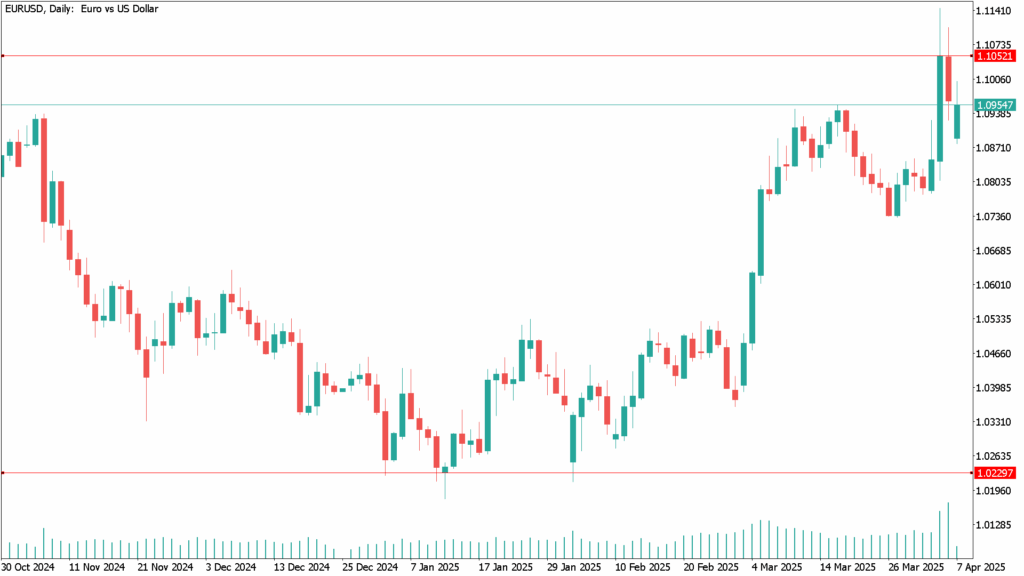

EUR/USD Daily Technical Analysis for April 7

On the daily chart, EUR/USD remains above all key moving averages, with the 20-day SMA maintaining a bullish slope above longer-term indicators, currently around 1.0860. Despite an intraday pullback, technical indicators remain in positive territory, suggesting limited downside risk for now.

Support Levels: 1.0900, 1.0860, 1.0800

Resistance Levels: 1.1000, 1.1050, 1.1100, 1.1145

A decisive move above 1.1050 could open the door for further gains, while a break below 1.0900 may weaken the bullish outlook. For now, the battle around 1.1000 remains key to the pair’s next direction..