EUR/USD Expectations Focus on the European Central Bank’s

The EUR/USD starts the week with attention on the European Central Bank’s (ECB) latest policy decision scheduled for December 12, where markets anticipate a 25 basis point rate cut.

Political Turmoil in France Weighs on the Euro

The euro has also been affected by political turmoil in France. The minority government virtually collapsed after a no-confidence vote ousted French Prime Minister Michel Barnier on Wednesday. The vote followed Barnier’s controversial use of a constitutional article to push through a law cutting the social security budget.

Key Data Releases Ahead of ECB Decision

- Germany’s HICP: Before the ECB announcement, Germany will release its final November Harmonized Index of Consumer Prices (HICP) estimate, expected to confirm a 2.4% year-on-year increase.

- US CPI: In the United States, the Consumer Price Index (CPI) for November will be released on Wednesday, expected to remain steady at 0.2% month-over-month. Inflation currently appears to be less of a concern for the Federal Reserve, and even higher-than-expected CPI figures are unlikely to alter the Fed’s monetary policy stance.

- US PPI: The Producer Price Index (PPI) for November, due on Thursday, is also unlikely to significantly influence markets as it will follow the CPI release.

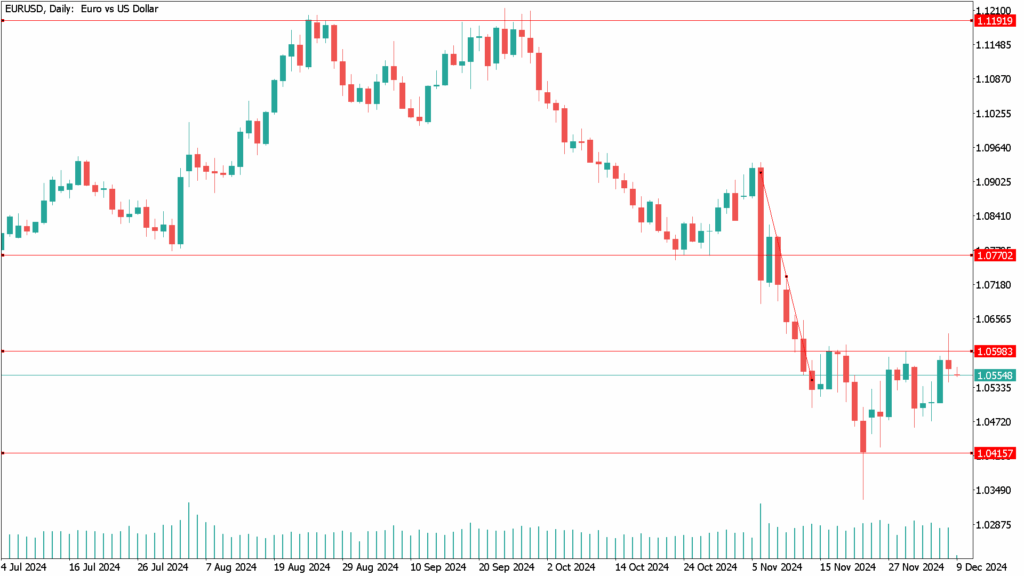

EUR/USD Daily Technical Analysis for December 9th

For the EUR/USD daily chart on December 9, the pair remains in a neutral trend. It is positioned above a bearish 20 SMA, offering support around 1.0540, while both the 100 SMA and 200 SMA are gaining strength to the downside, more than 200 pips above the current level. Technical indicators are showing mixed signals, with the Momentum indicator flat at the 100 line, indicating indecision. The Relative Strength Indicator (RSI) is at 46, slightly tilting risk to the downside.

In terms of support, immediate levels are found at 1.0540 and 1.0500. A break below 1.0500 would expose the 1.0440 region, which marked the low for the pair in October. If this level is breached, the 1.0320-1.0330 area would be the next downside target. Resistance is at 1.0630, followed by the 1.0700 level. However, it seems unlikely that the pair will break through 1.0700 given the ECB’s expected policy moderation.

Overall, the EUR/USD pair remains range-bound, with downside risks prevailing. The ECB’s decision and the US CPI data will likely dictate the pair’s direction in the short term, with the possibility of testing lower support levels before any substantial upside moves..