Daily Technical Analysis EUR/USD: Trading Below 1.0500 Amid US Dollar Recovery from Monthly Lows

The US dollar gained strength following the release of mixed data from the US Purchasing Managers’ Index (PMI). Uncertainty surrounding the impact of President Donald Trump’s trade and immigration policies has further supported the Federal Reserve’s cautious approach to cutting interest rates in 2025.

US PMI Data Highlights Mixed Signals

Data from S&P Global on Friday showed that the US composite PMI fell to 52.4 in January from 55.4 in December. Meanwhile, the manufacturing PMI improved slightly to 50.1 in January, compared to 49.4 the previous month, beating estimates of 49.6. On the other hand, the services PMI dropped to 52.8 in January from 56.8 in December, falling short of the consensus estimate of 56.5.

This mixed PMI data lent support to the US dollar, as investors weighed the implications for economic activity and the Federal Reserve’s future policy actions.

Eurozone PMI Provides Support for EUR/USD

Despite the US dollar’s recovery, the euro received support from improving data in the eurozone. The preliminary composite PMI for the eurozone, reported by HCOB and produced by S&P Global, showed that business activity expanded in January after months of contraction. The composite PMI rose to 50.2 in January, up from 49.6 in December. This beat economists’ expectations, which forecasted a decline to 49.7.

However, the euro continues to face pressure due to ongoing concerns about the European Central Bank’s (ECB) monetary policy trajectory. The ECB is expected to cut its deposit facility rate by 25 basis points to 2.75% on Thursday and maintain this course over the next three monetary policy meetings. Policymakers believe this approach is necessary to ensure inflationary pressures sustainably return to the 2% target.

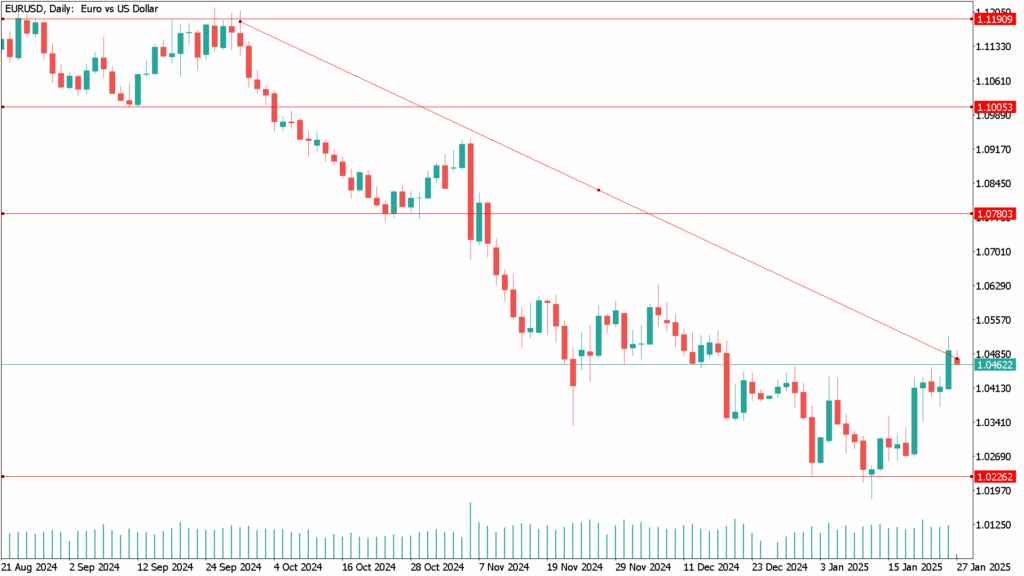

EUR/USD Daily Technical Analysis for January 27th

In the short term, bearish sentiment prevails as EUR/USD continues to drift further from its recent cycle lows recorded on February 20th.

Key Support Levels:

- 1.0176: A notable support level.

- 1.0000: The psychological support level that could come into play if bearish momentum intensifies.

Key Resistance Levels :

- 1.0514: The high from January 24, 2025.

- 1.0629: The high from December 2024.

A bearish alignment could intensify if the pair falls below the 200-day Simple Moving Average (SMA), currently at 1.0771.

Momentum Indicators :

- RSI (Relative Strength Index): Currently just above 60, suggesting a potential recovery in momentum.

- ADX (Average Directional Index): Rising slightly, around 27, indicating that the trend’s strength is fading.

The EUR/USD pair remains under pressure as the US dollar recovers from its monthly lows. While the euro received some support from improving eurozone PMI data, negative sentiment surrounding ECB policy estimates continues to weigh on the currency. The pair’s movement will likely depend on the interplay between US economic data and ECB policy decisions in the coming sessions. Traders should watch key support and resistance levels for potential breakout or retracement opportunities.