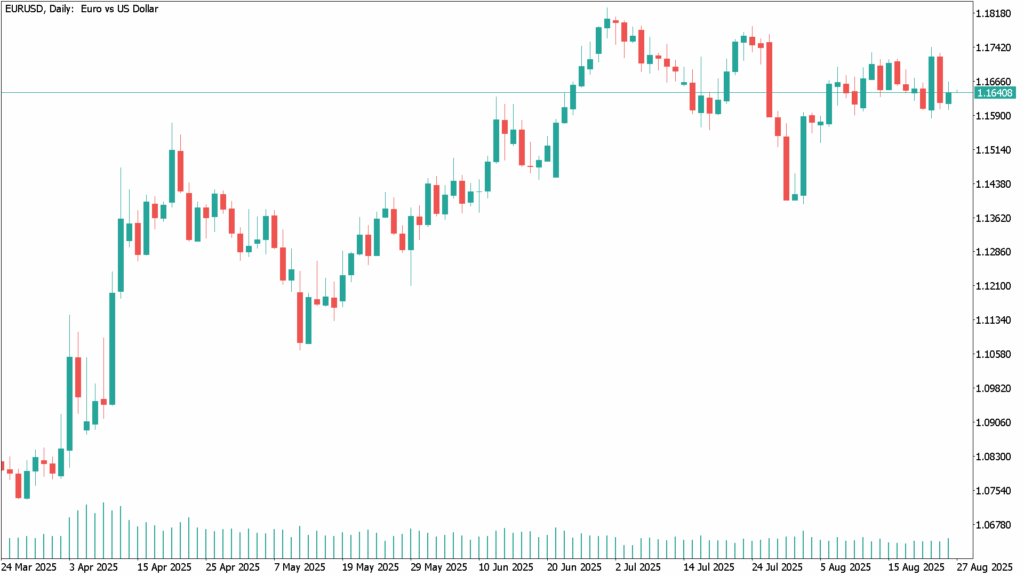

Daily Technical Analysis EUR/USD: Steady Below 1.1650 Amid Political Uncertainty

The EUR/USD pair traded within a narrow range on Wednesday, holding above the 1.1600 level but failing to build on an intraday high near 1.1660. On Tuesday afternoon in North America, the pair hovered around 1.1630 with no clear directional bias.

Political Headlines Weigh on Market Sentiment

Market sentiment struggled to remain positive after fresh political headlines from Washington. U.S. President Donald Trump threatened to impose new tariffs on countries that enforce digital taxes on American tech companies. In a post on Truth Social, he warned:

“I put all Countries with Digital Taxes, Legislation, Rules, or Regulations on notice that unless these discriminatory actions are removed, I, as President of the United States, will impose substantial additional Tariffs on that Country’s Exports to the U.S.A.”

Adding to the tension, Trump announced the dismissal of Federal Reserve Governor Lisa Cook over alleged irregularities in mortgage applications. Cook, however, refused to step down, arguing that the President lacks authority to remove her. The dispute is expected to move into the courts, further clouding perceptions of Fed independence.

With a light macroeconomic calendar this week, traders have been taking cues primarily from political and fiscal developments. The key data release ahead is the U.S. Personal Consumption Expenditures (PCE) Price Index on Friday, the Fed’s preferred measure of inflation.

EUR/USD Daily Technical Analysis – August 27

On the daily chart, EUR/USD remains just above the flat 20-day Simple Moving Average (SMA), reflecting the absence of directional momentum. Technical indicators also linger near their midlines, confirming a lack of conviction.

Immediate support is seen at the weekly low of 1.1602, followed by 1.1583. A break below these levels could trigger renewed selling pressure. On the upside, resistance lies at 1.1700, with further gains facing last week’s high at 1.1741.