Disney Transitioning to Profitable Growth

When speaking of Christmas, it is difficult for many not to think of a company that has accompanied them—and continues to do so—with its cartoons during this period throughout the years. The Walt Disney Company (DIS) has faced some challenging years recently but throughout 2025 it has completed its strategic pivot from aggressive subscriber acquisition to bottom-line efficiency. Under CEO Bob Iger’s restructuring, the company has consolidated into three core segments: Entertainment, Sports, and Experiences.

The 2025 strategy focused on content rationalization. Disney reduced its volume of theatrical and streaming releases to mitigate franchise fatigue, emphasizing high-quality tentpole films. The company maintained dominance in theme parks and cruises (Experiences) while achieving a long-awaited milestone: consistent profitability in its Direct-to-Consumer (DTC) streaming business (Disney+). 2025 was also the year when Disney finalized its 100% ownership of Hulu and successfully closed the merger between Hulu+Live TV and Fubo,

Disney’s flywheel remains unrivaled. Its massive IP library (Marvel, Star Wars, Pixar) fuels high-margin revenue across parks, merchandise, and streaming. The Experiences segment continues to be the primary engine, showing record operating income of approximately $10 billion for the fiscal year.

However, the persistent decline of Linear Networks (ABC, Disney Channel) continues to drag on growth. High content production costs and the expensive transition of ESPN to a standalone streaming model remain significant financial risks.

Disney’s balance sheet has strengthened this year with total debt reduced to approximately $42 billion and a healthy Debt-to-Equity ratio of 0.37, outperforming many legacy peers. While Netflix leads in streaming margins, Disney’s diversified revenue from theme parks provides a “safety net” that pure-play streamers lack. Conversely, it is far better capitalized than Warner Bros. Discovery, which continues to struggle with heavy debt.

Technical Analysis

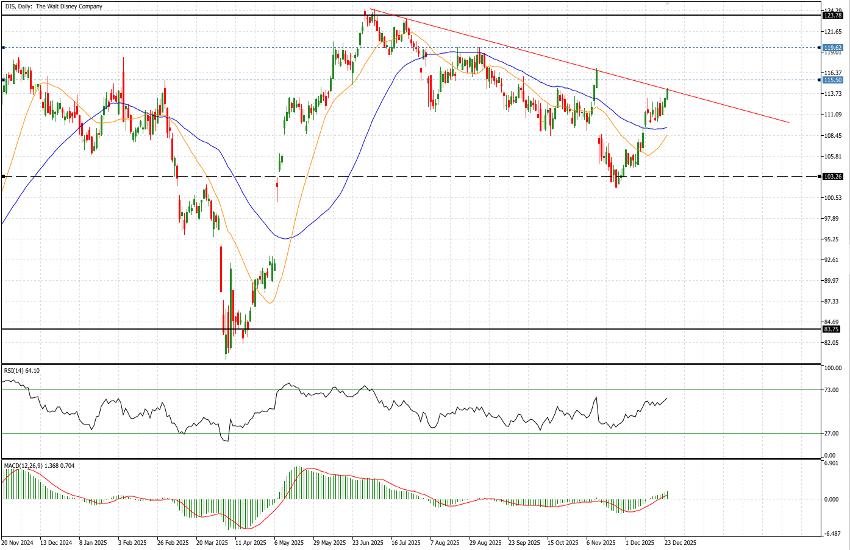

The weekly chart illustrates the investor skepticism that has weighed on the company since late 2021. During this period, the stock experienced a rapid collapse, effectively losing half its value as it plummeted from the $170–$185 range to the $85 support zone (and briefly lower). For the past three years, the stock has traded within a well-defined sideways range, oscillating primarily between the aforementioned $85 floor and a ceiling near $124; the $100–$105 level also appears to act as a significant pivot point. This price action reflects a “wait-and-see” approach from traders, who are monitoring the execution of the company’s strategic pivot—a transition that, as always, carries inherent risks.

The daily chart presents a more promising outlook, or at least the potential for one in the near term. As of the December 24 close, the price is testing a descending trendline that has historically capped gains. A breakout above this trendline before year-end would be a bullish signal, clearing the path to retest the $124 resistance level, though the stock must first navigate intermediate hurdles at $115.50 and $119.60. Constructive momentum is further supported by the RSI and MACD indicators, both of which are trending positively. Additionally, the price has recently reclaimed its 21-day and 50-day moving averages. Notably, these averages are converging toward a bullish crossover (Golden Cross), with the fast moving average trending upward.

Provided the stock can establish a foothold above the $115.50 level, Disney could offer some upside; furthermore, the stock has recently exhibited a low correlation with the broader indices and Mega-Cap Tech giants. This decoupling could provide a valuable diversification benefit for portfolios in the event of upcoming sectorial rotations.