EUR/JPY Softens Slightly Ahead of ECB, BoJ Later This Week

The Euro Area exports goods to Japan worth approximately EUR 70 billion per year, primarily pharmaceuticals and medical equipment (around EUR 18 billion), as well as machinery and vehicles. At the same time, it imports goods from Japan with a total value of roughly EUR 100 billion, resulting in a trade deficit of about EUR 2.5 billion per month. In isolation, and according to classical economic theory, this dynamic would be decidedly negative for the common currency against the yen. However, it is worth noting that the United States has run a persistent trade deficit since 1975 without this having destabilized the US dollar.

Several additional factors, however, argue against the Japanese currency, starting with GDP dynamics. After a strong first half of the year, with growth rates reaching +2% in Q2, economic activity slowed markedly in Q3, which recorded a 2.3% year-on-year contraction. This downturn was largely driven by a decline in capital expenditure, reflecting higher financing costs.

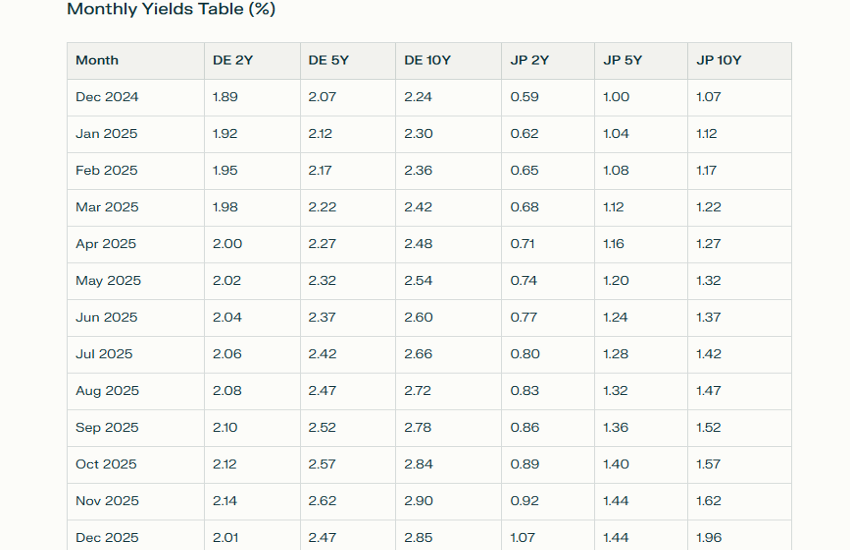

This leads to one of the key fundamental drivers of currency relationships: interest rates. In Japan, rates have risen significantly and rapidly over the past year, with the entire yield curve—from 2-year to 10-year maturities—showing a much larger percentage increase than its European counterpart. Both the 2-year and 10-year Japanese government bond yields have effectively doubled in 2025. Despite this sharp repricing, absolute yield levels remain higher in Europe across the curve, including policy rates (0.50% for the Bank of Japan versus 2.15% for the ECB), which constitutes a clear structural advantage for the euro—an advantage that markets appear to have decisively priced in.

That said, analysts expect the Bank of Japan to raise its policy rate to 0.75% this week, the highest level in the past 30 years. Such a move would represent a further step toward narrowing the interest rate differential between Japan and the Euro Area.

TECHNICAL ANALYSIS

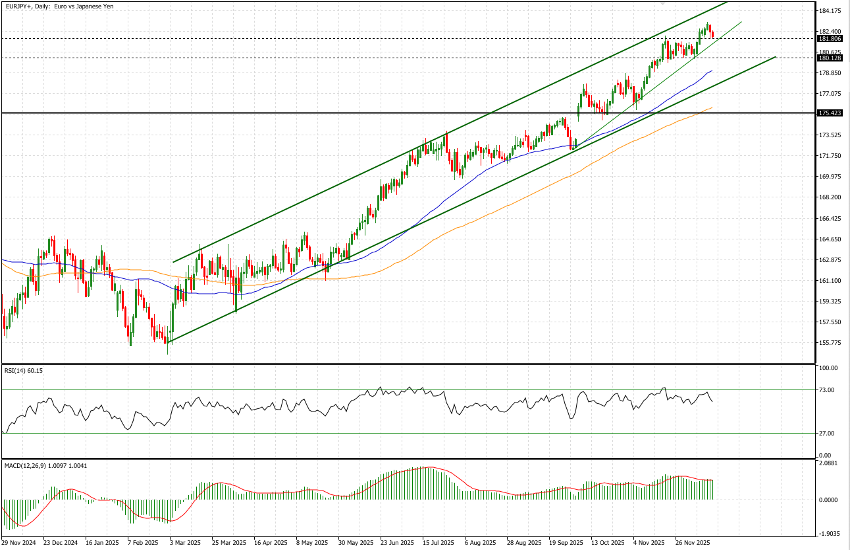

EUR/JPY has been in a persistent uptrend—reflecting sustained yen weakness—since 28 February 2025, when the cross bottomed at 154.79, compared with the current level of 182.02. From a trading perspective, a constructive feature of this move has been its orderly nature: price action has largely respected a well-defined rising channel, with only brief and limited deviations beyond its boundaries.

It is worth noting that the bullish impulse that began in September, following the breakout above the previous high of 175.42 (set in July 2024), has so far failed to retest the upper end of that prior range—at least not yet. That level also defines a clear descending trendline, which was tested in early November and again in early December.

The technical indicators we typically monitor—RSI, MACD, and the long-term 50-day (179.01) and 100-day (175.92) moving averages—remain firmly supportive of the bullish trend. That said, the cross is coming off a negative session and, at the time of writing, is down around 0.20%.

Against this backdrop, key levels to monitor on the downside are the recent local low at 181.80 and, more importantly, the late-November low at 180.13. A test of the latter could imply a break of the most recent upward trendline (to be confirmed), potentially opening the way for a move toward the 50-day moving average in the 179 area and, in a more pronounced correction, toward the lower boundary of the channel, currently around 177.75.

Conversely, should the yen weaken again as this week’s events unfold, a first natural upside target would be the recent highs at 183.15, followed by a potential test of the upper end of the rising channel, which currently projects to approximately 184.60.