EURUSD Outlook: Tariffs, Ecofin, Davos and Key Data in Focus

While global attention is focused with a degree of apprehension on the fratricidal dispute within NATO triggered by the Greenland issue, and markets attempt to assess the potential implications of reciprocal tariff threats between countries on opposite sides of the Atlantic alliance, a number of other significant events and meetings are scheduled for this week.

First and foremost, given that this note will later address EUR/USD dynamics, the Eurogroup meeting has been underway in Brussels since yesterday, followed today by the gathering of finance ministers within the ECOFIN framework. In addition, it is widely known that this week marks the World Economic Forum in Davos, Switzerland, the annual meeting point for leading political and economic decision-makers.

Against this backdrop, several ECB officials are expected to speak publicly in the coming days, most notably President Lagarde, who is scheduled to deliver remarks on two occasions tomorrow from Switzerland. From Nagel to Escrivá, via Villeroy, a broad range of senior central bank figures will provide insight into their assessment of the euro area economy and the likely policy path ahead. At the same time, a dense macroeconomic calendar will require close monitoring, including European economic and consumer confidence indicators, the Federal Reserve’s preferred inflation gauge (PCE), as well as PMI releases on both sides of the Atlantic.

These events come at a time of mild divergence across sovereign bond markets. German Bunds, Bobls and Schatz have been trading in positive territory for roughly three weeks, while U.S. Treasuries remain broadly flat and experienced a notable sell-off yesterday. Finally—and far from insignificantly—Japanese yields have surged sharply, with the very long end of the curve (40-year JGBs) rising above 4%, and, as highlighted in yesterday’s commentary, the 10-year JGB reaching its highest level in three decades.

TECHNICAL ANALYSIS

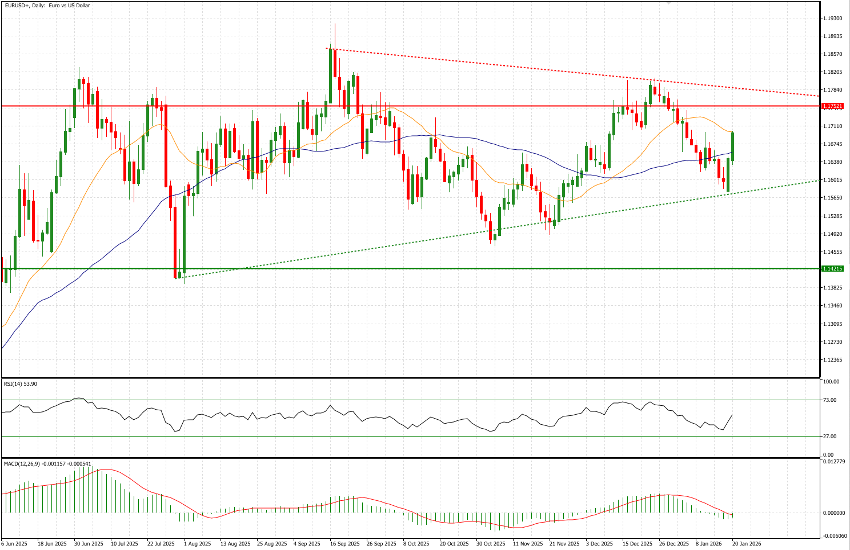

We begin with a very long-term perspective—covering the past ten years—consistent with the conviction that any financial instrument should first be assessed within a broader timeframe in order to understand its historical positioning before moving to finer levels of detail. In the weekly chart below, the relevance of the levels around which the pair has traded over the past six months is clearly visible: on the downside, the area around 1.1420, and on the upside, around 1.1750, have repeatedly acted as strong support and resistance levels in the past—most notably in 2015, during the 2017–18 period, and again in 2020–21. It is therefore not surprising that, following the rally in the first half of last year, EUR/USD has paused to consolidate within this broad range.

That said, within this range we focus on an emerging structure of higher lows, which gained traction with yesterday’s renewed move higher from the 1.1575 area. The August low at 1.14 has not been retested; however, between October and November the pair declined to the 1.1475–1.15 region, and this week the most recent corrective move stalled precisely in the area mentioned above. At the same time, the August peak settlement at 1.1870 has also not been revisited, with the pair last closing around 1.1795 on December 23. These two relatively weak trendlines will serve as our key reference points in the coming days and—as always—only a clear and confirmed break would lead us to anticipate an extension of the move.

It is also worth noting that today the price has broken above the 50-day moving average and is currently testing the 21-day moving average near 1.17. This level is likely to represent initial resistance; a confirmed break would open the way toward 1.1720 and subsequently 1.1745. On the downside, the 1.1650 level—broken earlier this morning—remains an important reference. Finally, the MACD has turned negative, and of equal, if not greater, importance is the consideration that a sustained risk-off move typically continues to channel flows into the U.S. dollar, given its safe-haven status.

In summary, price action remains range-bound for the time being, and we will continue to monitor 1.1575 and 1.1785 as the boundaries within which EUR/USD is likely to trade over the coming days.