Natural Gas Attempts Rebound as Winter Demand Peaks

This is a period in which the global economy appears to be moving toward a “cold war” in commodities and, quite possibly, toward a new Supercycle—one not seen since the early 2000s. While the US continues to project its military and political power through actions, threats, and tariffs, China is steadily imposing restrictions on key commodities and rare earths for which it is either the dominant global producer or the primary refiner.

In January 2026, new measures came into force targeting Gallium and Germanium—rare earths largely unknown to the general public. Silver has also been included among the commodities subject to these restrictive measures, with China accounting for roughly 60% of global production, following its designation as a strategic raw material by the US administration in November 2025.

With regard to the notion of a “Supercycle,” it is worth recalling that Oil reached a peak of $147 per barrel in 2008, compared with approximately $59.5 today. Similarly, investors who allocated capital to the traditional safe haven of Gold at $1,900 in 2011 had to wait more than a decade before their investment clearly moved into positive territory. At that time—toward the end of the first decade of the 2000s—institutional investors allocated close to 15% of their portfolios to commodities; today, that figure stands at roughly 3%.

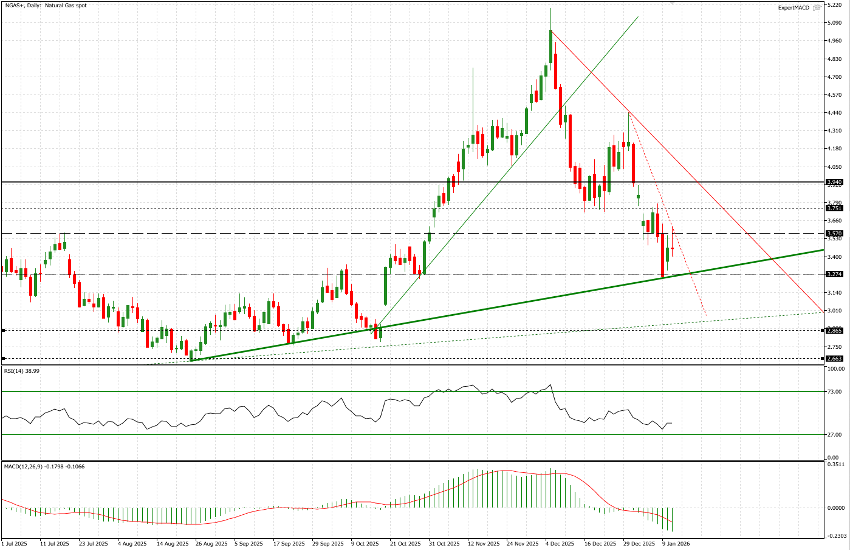

Against this backdrop, we return to an energy asset that is both highly seasonal and strongly decorrelated: Natural Gas (NGas), which we discussed a few weeks ago. At the time, prices were trading around $4, and following the break of an upward trend, we highlighted the potential for further downside toward the $3.57 area. The move ultimately proved much more pronounced: after a gap down through that level, prices briefly traded as low as $3.123. The current quotation stands at $3.344.

TECHNICAL ANALYSIS

It is often highly useful and effective to define a long-term framework and observe how price action evolves within it, without being unduly influenced by short-term fluctuations. Following the break of the steeper trendline last December—discussed in our previous post on natural gas—all static supports, even those considered significant, were breached. The subsequent rebound occurred precisely at the less steep trendline originating in late August 2025, at approximately $3.253.

From that level, prices moved back to retest the $3.57 area we highlighted as recently as yesterday. Based on RSI and MACD readings, conditions do not yet appear conducive to a sustained upside move. On the contrary, we cannot rule out a further test of the $3.00 area, where a solid long-term upward trendline—originating in late 2023—comes into play. We would, however, expect such a test to be brief.

Should prices reach that zone, our base case is that natural gas could then embark on the final upward leg of the season, likely concluding toward late February or March: The natural targets are at least in the $3.75–3.94 range. If this scenario proves incorrect and bearish momentum persists, close attention should be paid to the $2.665 level.