Nikkei Faces the Test of Potential Snap Elections

According to reports circulated last week, initially by Japanese broadcaster NHK, Japan’s Prime Minister Sanae Takaichi is planning to dissolve parliament this week and call a snap general election, with February 8 being considered as a possible election date. Japan’s first female prime minister, Takaichi aims to capitalise on the surge in public support for her government since taking office in October, while also giving voters the opportunity to pass judgment on the Liberal Democratic Party’s new coalition with the right-wing Japan Innovation Party.

The election will also serve as a test of public support for proposals to increase government spending in order to revive economic growth and raise defence expenditure under a revised national security strategy.

The reports triggered a sell-off in the Japanese yen and government bonds, as investors grew concerned about how one of the world’s most heavily indebted advanced economies would finance an expansionary fiscal agenda. The 10-year Japanese Government Bond yield currently stands at 2.271%, its highest level since 1998. Over the longer term, this could pose risks to global economic stability, given the sheer size of Japan’s financial and insurance sectors, which may gradually begin to repatriate part of their foreign investments as domestic yields become increasingly attractive.

Against this backdrop, it is worth examining how Japan’s equity market—specifically the Nikkei 225 index—is evolving.

TECHNICAL ANALYSIS

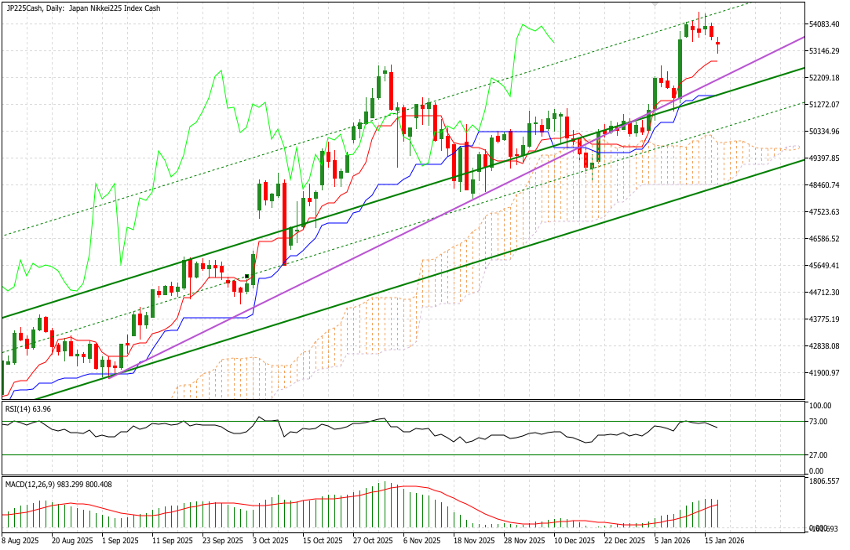

JP225Cash has experienced several very strong months, rising by 51% from the 35,750 area at the beginning of May—once it stabilised after the post-tariff-announcement decline—to 53,679, the level at which it closed last Friday. The index has once again been framed within a channel and now appears to be approaching its upper boundary. The acceleration that began in September was also recently tested successfully between mid and late December.

Ichimoku remains firmly positive, with price trading above the cloud, which is relatively thin, indicating low volatility. The Tenkan-sen (fast line) is above the Kijun-sen (slow line), and these levels would represent the first areas of support in the event of a pullback. Considering the risk-off tone with which markets opened this morning following US–EU tensions, these support levels can be identified around 52,750—also the previous high reached by the index in early November—and approximately 51,500.

For investors considering long positions, these could represent attractive entry levels, corresponding to declines of approximately 1.25% and 3.6% from current levels, respectively. On the upside, key reference levels are 53,600, 54,100, and the all-time high at around 54,475. RSI and MACD remain strongly positive.