Daily Technical Analysis EUR/USD : Drops Close to 1.1300 as Traders Watch U.S. ISM Services PMI

The EUR/USD pair opened the week under pressure, trading near 1.1320 during Monday’s European session. The U.S. dollar drew some support after former President Donald Trump confirmed he would not attempt to remove Federal Reserve Chair Jerome Powell before his term ends in May 2026. Despite branding Powell as “a total stiff,” Trump reiterated his belief that interest rates should eventually be lowered—a stance that markets have largely priced in.

Adding to downside pressure on the euro, Trump also unveiled plans to instruct the U.S. Trade Representative and Commerce Department to initiate procedures for a 100% tariff on foreign-produced movies. While still in early stages, such rhetoric raises the risk of renewed trade tensions, dampening overall market sentiment.

Robust U.S. Labor Data Lifts the Greenback

On the economic front, April’s U.S. Nonfarm Payrolls (NFP) report came in stronger than expected, with 177,000 jobs added versus the forecast of 130,000. March’s figure was also revised slightly lower to 185,000. The unemployment rate held steady at 4.2%, and average hourly earnings maintained an annual growth rate of 3.8%. The data helped support the U.S. dollar and added pressure on EUR/USD. Later today, attention will turn to the U.S. ISM Services PMI for further market direction.

Euro Supported by Resilient Inflation Data

Despite early weakness, the euro remains underpinned by stronger-than-expected Eurozone inflation figures released on Friday. The Harmonized Index of Consumer Prices (HICP) remained at 2.2% year-over-year in April, edging above the 2.1% forecast. Core inflation (excluding food and energy) rose to 2.7%, while services inflation accelerated to 3.9%—both above expectations. These figures reinforced investor expectations of approximately 60 basis points in cumulative rate cuts by the European Central Bank (ECB) before the end of the year.

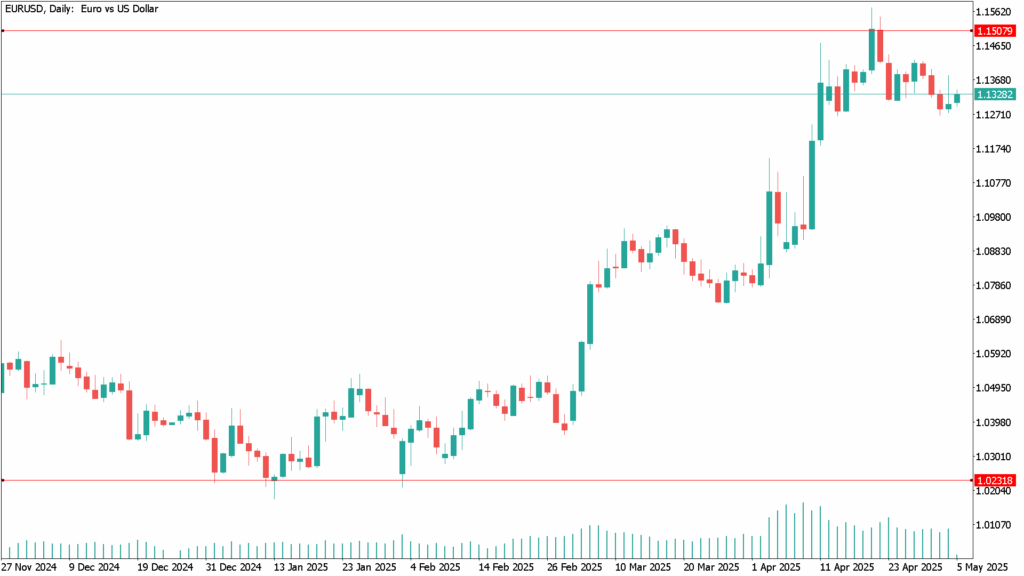

EUR/USD Daily Technical Analysis for May 5th:

On the daily chart, EUR/USD has rebounded from the bullish 20-day Simple Moving Average (SMA), currently hovering near the 1.1300 level. The longer-term 100-day and 200-day SMAs continue to trend higher, more than 500 pips below current price levels, indicating persistent underlying bullish momentum. Technical indicators are stabilizing around their midpoints, suggesting that the recent downward correction may be losing steam.

Immediate resistance is seen near 1.1400, followed by the 1.1470 area. A break above these levels could open the door toward the yearly high at 1.1573, with a further extension targeting the 1.1600 psychological level. On the downside, initial support lies at 1.1300, followed by the 1.1260 region. A break below this zone may trigger deeper losses toward the 1.1160–1.1170 support area.

While EUR/USD begins the week on a softer tone, resilient Eurozone inflation data and broader U.S. political uncertainty could continue to limit downside potential. With key U.S. services data due later and central bank commentary expected in the days ahead, traders should remain alert for fresh directional cues in what could be a pivotal week for the currency pair.