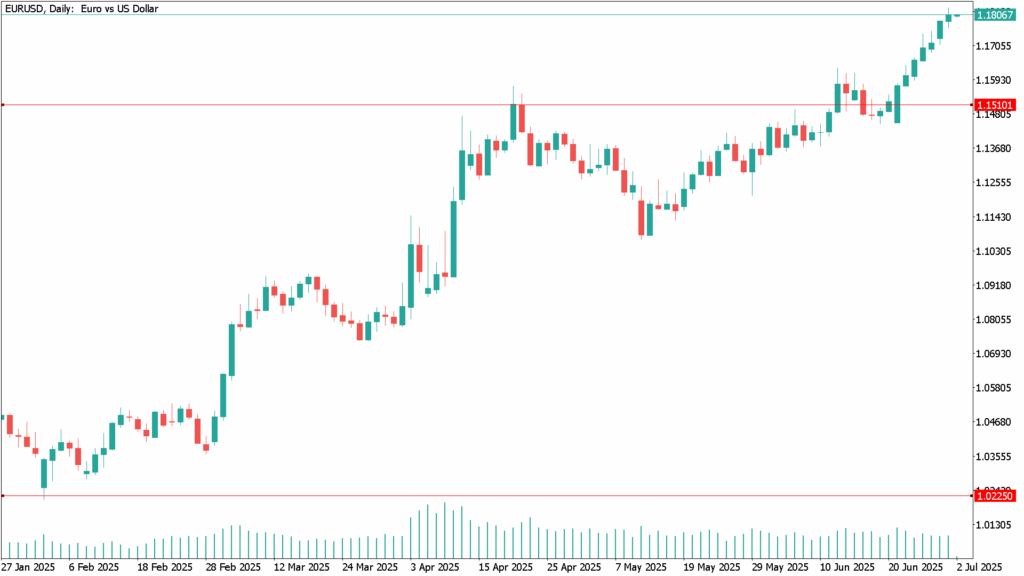

Daily Technical Analysis EUR/USD: Surge Slows at Multi-Year Highs — Tax Reform and Yields Bring Gains to a Stop

The EUR/USD pair remained flat during Wednesday’s session, hovering around 1.1780 after briefly touching a multi-year high of 1.1830. The euro’s advance lost steam following the U.S. Senate’s approval of President Trump’s $3.3 trillion “One Big Beautiful Bill,” which includes the entirety of his legislative agenda. The bill, passed by a 51–50 margin with Vice President JD Vance casting the tie-breaking vote, now heads to the House for expected approval. Rising U.S. Treasury yields also capped euro gains.

U.S. Economic Data Supports Fed’s Cautious Stance

On the data front, the U.S. economy continues to justify the Fed’s cautious stance. May’s JOLTS report showed job openings rose to 7.77 million—well above forecasts—while the ISM Manufacturing PMI for June edged up to 49.0 but remained in contraction for a fourth month.

At a central banking forum in Portugal, Fed Chair Jerome Powell maintained a wait-and-see approach, stating it’s too early to predict a July rate cut.

ECB Warns of Strong Euro; Inflation Data Steady

Meanwhile, ECB officials signaled that inflation is easing, with Vice President Luis De Guindos warning that a EUR/USD above 1.2000 would be “complicated.” ECB President Christine Lagarde echoed a cautious tone, emphasizing continued vigilance on inflation.

In the Eurozone, June’s HICP inflation matched expectations at 2% YoY, while core inflation held steady at 2.3%. Manufacturing data from HCOB and S&P Global pointed to slight improvements, though activity remains in contraction territory.

U.S. Dollar Index Supported by Economic Strength and Uncertainty

The U.S. Dollar Index (DXY) ticked up 0.02% to 96.80, supported by economic data and policy uncertainty. Market focus now shifts to the upcoming U.S. Nonfarm Payrolls report, expected to show a cooling labor market, with only 110,000 new jobs projected and unemployment ticking up to 4.3%.

EUR/USD Daily Technical Analysis – July 2

EUR/USD’s uptrend remains intact, though a doji formation suggests near-term consolidation. A break above 1.1800 could retest resistance at 1.1829, 1.1850, and 1.1900. On the downside, support lies at 1.1750, followed by 1.1700 and 1.1653.