Cocoa Prices Slide on Supply–Demand Imbalance

Today is a public holiday in both the United States and Canada, and markets in China will remain closed for the entire week. The macroeconomic calendar is light, aside from the already released and disappointing Japanese GDP data. More broadly, markets are reopening in a subdued and lethargic tone following the weekend.

Against this backdrop, we will turn our attention to a topic somewhat different from the usual focus: an agricultural soft commodity—cocoa.

Cocoa is currently trading near $3,700 per metric ton, reflecting a decline of nearly 30% over the past month and approximately 60–65% year over year. This correction follows the extreme price spike observed in late 2024, when futures briefly exceeded $12,000 per ton amid acute supply concerns and weather-related disruptions in West Africa.

The present downturn is primarily driven by two fundamental shifts: an anticipated return to a global supply surplus for the 2025/26 season and sustained weakness in industrial demand. Favorable weather conditions across West Africa—particularly in Côte d’Ivoire and Ghana—have improved pod development and crop quality. As a result, analysts are projecting a global surplus in the range of approximately 175,000 to 287,000 metric tons.

At the same time, demand destruction has become evident. Cocoa grindings—a proxy for industrial chocolate production—have declined to multi-year lows. Fourth-quarter 2025 data show an 8.3% year-on-year contraction in European grindings and a nearly 5% decline in Asia, as elevated retail prices have prompted consumers to trade down to lower-cost alternatives or reduce discretionary chocolate consumption altogether.

Seasonally, cocoa supply is dominated by West Africa’s main crop (October–March), followed by a smaller mid-crop (April–September). Prices typically strengthen during peak grinding periods, when European and North American manufacturers build inventories ahead of seasonal holiday demand. Conversely, prices often soften during peak harvest windows as supply pressures intensify.

Despite the recent correction, the medium-term outlook remains structurally constructive. Demand growth in emerging markets continues to offset slower consumption trends in mature Western economies. Managed money positioning indicates a reduction in net long exposure, though investors retain a constructive longer-term bias given structural supply constraints—including aging tree stocks, climate volatility, and insufficient replanting across producing regions.

The physical market remains relatively tight. Port inventories in Côte d’Ivoire are below historical averages, and processors continue to adopt hand-to-mouth purchasing strategies. Forward curves and bank research currently incorporate expectations of another global surplus in 2025/26 and average prices materially below the 2024 peak, though still above pre-2023 norms.

In summary, the market appears to be transitioning into a phase of price normalization and balance sheet repair. However, volatility is likely to remain elevated, with pricing highly sensitive to any renewed weather disruptions or policy developments in West Africa.

TECHNICAL ANALYSIS

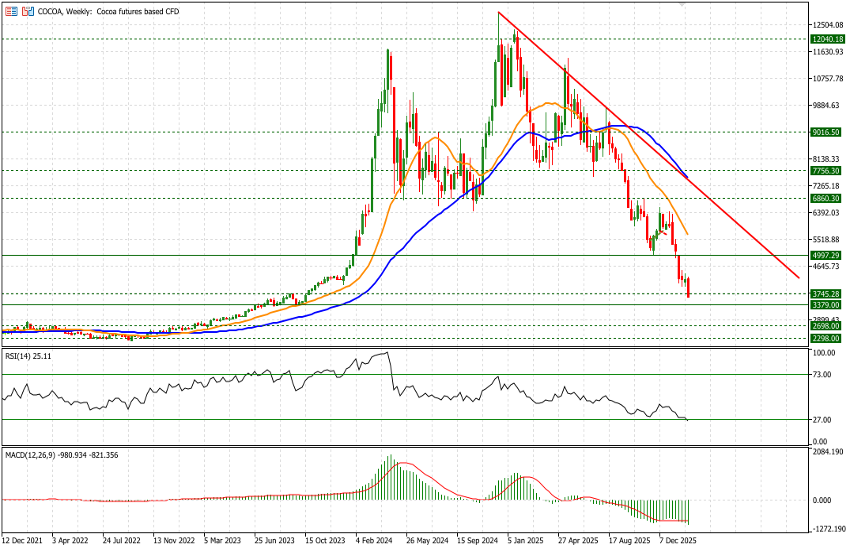

What makes this type of instrument particularly attractive is its near-total lack of direct correlation with most traditionally traded markets—namely FX, equities, and major commodities—as is clearly illustrated on the weekly chart.

The collapse and ongoing downtrend from the USD 12,000 peak to the current USD 3,640 level in just one year are unmistakable, with no clear signs of stabilization at this stage. All major technical levels have been breached, notably USD 6,850 and, more recently, USD 5,000. The next significant support appears to lie around USD 3,380, approximately USD 250 below current levels.

However, given the elevated volatility and the time remaining before the grinding season, the possibility of deeper extensions toward USD 2,700 cannot be ruled out.

On the daily timeframe, price action continues to resemble a classic “falling knife.” The clearest technical reference is likely the dark purple descending trendline, currently intersecting near USD 5,450, which could serve as a potential target for any rebound at this stage. Interim resistance levels include the 21-day and 50-day moving averages.

That said, identifying the correct timing to initiate long exposure in a sharply declining commodity remains challenging. Although the RSI is in oversold territory and the next downside level we have identified—USD 3,380—appears relatively close, it still implies an additional 7% move lower. For this reason, we would avoid assuming that price levels are attractive merely because cocoa has already fallen substantially. Instead, patience is warranted while monitoring for credible long signals, such as a break above prior relative highs.

The market is down more than 70% from its peak one year ago, but to paraphrase a well-known remark often attributed to a former banker at JPMorgan Chase: “A security that has lost 75% is simply one that first lost 50%, and then halved again.”