EUR/USD Losing Ground on German Inflation and ECB Rate Cuts

The EUR/USD retreated on Tuesday after the latest inflation report in one of the eurozone’s most important economies, Germany, raised the possibility of an interest rate cut by the European Central Bank.

The EUR/USD slipped to 1.1021, as the decline in German inflation fuels expectations of a 25 basis point rate cut by the ECB on Thursday.

Wall Street ended the session with positive numbers, while the U.S. dollar remained flat. European session data indicated that inflation in Germany fell to its lowest level in more than three years, as the Harmonized Index of Consumer Prices came in at 2%, the ECB’s target level.

On Thursday, the European Central Bank is forecast to lower interest rates by a quarter percentage point, although according to analysts at BBH, the central bank will emphasize that it will keep monetary policy tight for as long as needed.

In addition, the ECB is expected to update its economic forecasts, including a downward revision of both economic growth and inflation. FX traders continue to bet on cuts between 50 and 75 basis points through the end of the year.

Looking ahead this week, the consumer price index for August in the U.S. is expected to be close to the Fed’s target of 2%. A lower-than-expected CPI report could increase the chances of the Fed easing interest rates by 50 basis points, even though most analysts believe that the Fed will tighten policy gradually.

CME’s FedWatch tool indicates that the chances of a 25 basis point rate cut are 70%, while the chances of a 50 basis point rate cut are 30%.

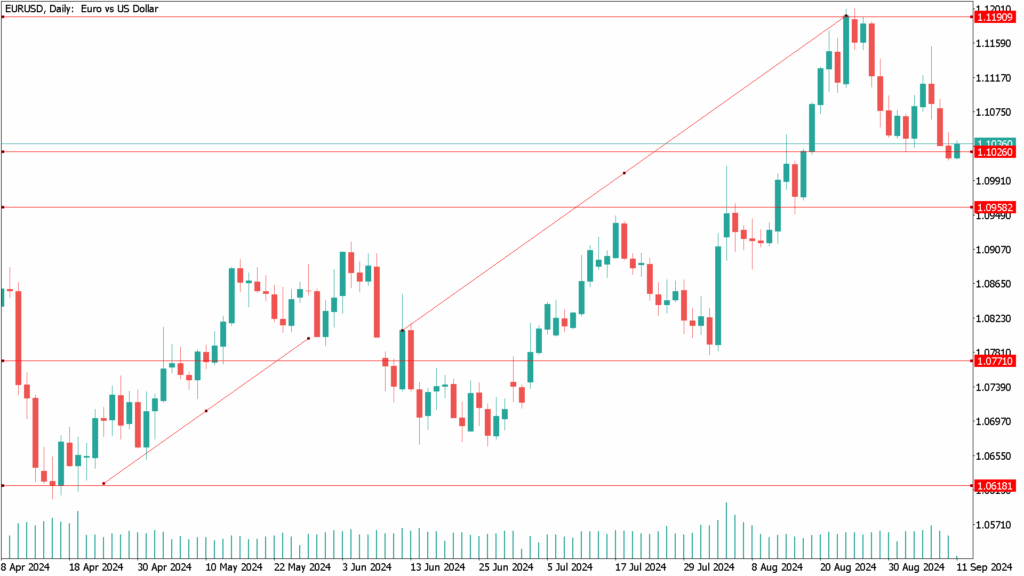

EUR/USD Daily Technical Analysis for September 10:

In technical terms, EUR/USD is neutral with a possible bullish bias. However, a sharp break below the September 3 low at 1.1026 could open the door to further declines. Key support levels will remain exposed, such as the 1.1000 level, followed by the 50-day moving average (DMA) at 1.0958. A break of this level could lead to a test of the convergence of the 100 and 200 DMA around 1.0867/58, before heading to the August 1 low at 1.0777.

To resume the uptrend, investors would need to break above the September 9 high at 1.1091.