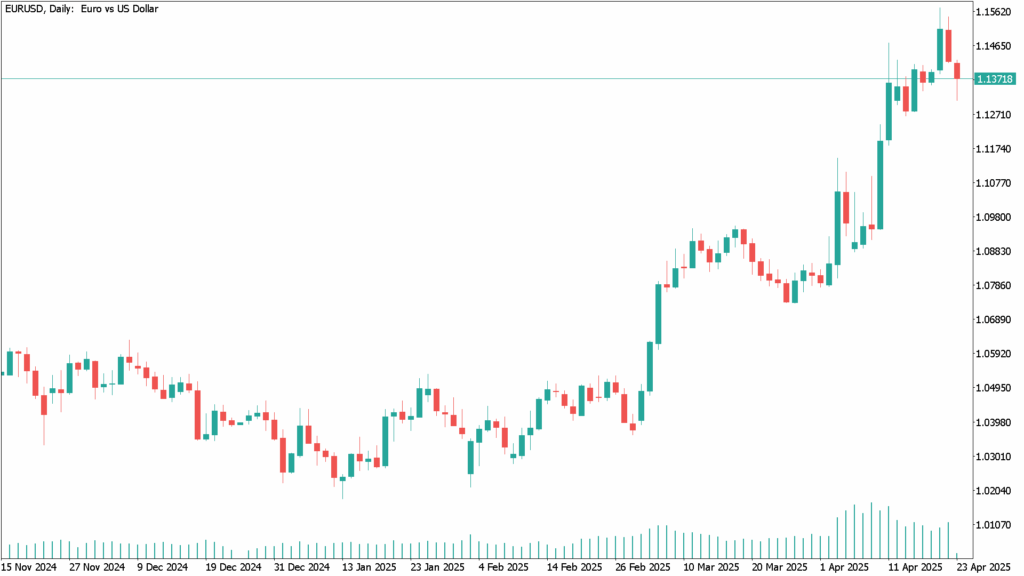

Daily Technical Analysis EUR/USD: Pair Drops Toward 1.1350 on Dollar Strength

The EUR/USD pair faced fresh selling pressure during the session on Wednesday, pulling back toward the 1.1355 area. The move comes as the U.S. dollar regains traction, supported by a renewed wave of investor confidence in the greenback following developments on both the monetary policy and trade fronts.

U.S. President Donald Trump helped calm investor nerves by clarifying that he has no plans to dismiss Federal Reserve Chair Jerome Powell, despite expressing dissatisfaction with the Fed’s reluctance to lower interest rates more aggressively. His reassurance contributed to a rebound in the dollar after recent weakness.

Adding to the dollar’s strength were upbeat comments from the White House regarding ongoing trade negotiations. On Tuesday, Press Secretary Karoline Leavitt stated that 18 countries have submitted trade proposals to the U.S., and meetings are underway with 34 nations to explore potential agreements. These positive signals around global trade talks—especially after the earlier sweeping tariffs announced by Trump—further boosted confidence in the dollar and added downward pressure on the EUR/USD pair.

Meanwhile, hawkish tones from Federal Reserve officials continue to provide additional support for the USD. Fed Governor Adriana Kugler emphasized on Tuesday that the recent surge in import tariffs is likely to drive inflation higher, reinforcing the need for the Fed to maintain its current interest rate levels until inflationary risks subside.

Euro Pressured by Dovish ECB Outlook

On the European side, expectations are rising that the European Central Bank (ECB) could implement another rate cut as early as its June meeting. According to LSEG data, market pricing for a June rate reduction has climbed to nearly 75%, up from about 60% prior to the ECB’s recent decision. This dovish shift continues to weigh on the shared currency, limiting the EUR/USD’s ability to maintain upward momentum.

Key Data Ahead

Market participants now turn their attention to Wednesday’s release of the preliminary HCOB Purchasing Managers’ Index (PMI) data for April from both the Eurozone and Germany. On the U.S. side, the flash S&P Global Manufacturing and Services PMIs will also be closely watched for clues about the health of the U.S. economy.

EUR/USD Daily Technical Analysis for April 23rd

Despite the latest dip, the broader trend for EUR/USD remains bullish. The recent break above the 1.1550 resistance level underscores the strength of the upward move and signals continued control by the bulls.

The 14-day Relative Strength Index (RSI) remains stable above the 70 mark, indicating strong bullish momentum and a sustained overbought condition.

The MACD and Stochastic indicators also remain in overbought territory, reinforcing the likelihood of short-term consolidation or profit-taking but not signaling a trend reversal—unless the U.S. dollar stages a more decisive comeback.

Should PMI figures from the Eurozone—particularly Germany—beat expectations, the EUR/USD pair may regain positive momentum, potentially targeting a breakout above the next psychological resistance at 1.1600. Additional upside could be driven by escalating tensions between President Trump and Fed Chair Powell, as well as any deterioration in trade relations.

Conversely, meaningful progress in U.S. trade negotiations—particularly with the Eurozone or China—could provide fresh support for the dollar, prompting renewed profit-taking and potentially dragging EUR/USD lower. While short-term corrections are possible, any downside moves are likely to be contained unless key macro drivers shift significantly.