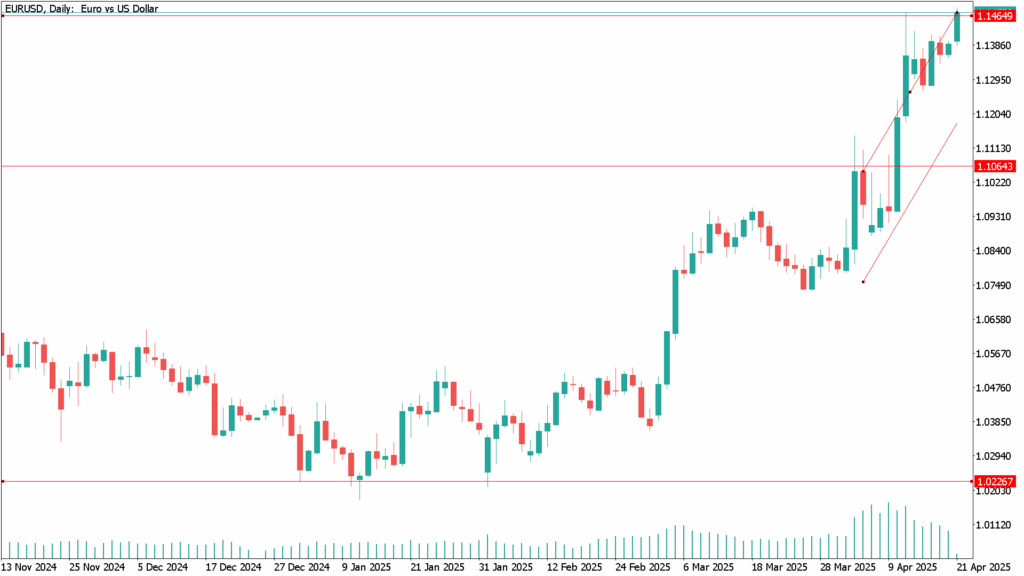

Daily Technical Analysis EUR/USD: Euro Climbs to 1.1485, Highest Since 2022 Amid Weak Dollar

On Monday, the EUR/USD pair broke out of a consolidation zone that had held for several days, reaching its highest level since February 2022, around 1.1485. The advance was driven by persistent bearish sentiment surrounding the U.S. dollar (USD), which favors the continuation of the strong uptrend that has characterized the pair in recent weeks.

This comes despite hawkish comments from Federal Reserve (Fed) Chairman Jerome Powell, who stated last Wednesday that the central bank is likely to keep its benchmark interest rate steady while waiting for more economic clarity before making further decisions. However, growing uncertainty surrounding President Donald Trump’s trade policies has undermined investor confidence in the U.S. economic outlook, pushing the dollar to a two-year low at the start of the week.

These factors largely offset the moderate tone of the European Central Bank (ECB), which last week cut its interest rate for the seventh time in a year. In addition, the ECB warned that economic growth could be seriously affected by U.S. tariffs, leaving the door open for more stimulus in the coming months. Despite this, the euro remained firm, supported by the weak dollar and reduced liquidity due to the Easter holiday on Monday.

Focus on Upcoming Data and Speeches

This week, markets will be watching for statements from ECB President Christine Lagarde on Tuesday, as well as speeches from several key members of the Federal Open Market Committee (FOMC). In addition, the release of preliminary PMI indices will be a key data point that could offer further signals on global economic health, with the potential to impact both the dollar and the euro.

Despite external uncertainty, the fundamental backdrop remains favorable for the euro, and any technical pullback could be seen as a buying opportunity by investors.

EUR/USD Daily Technical Analysis for April 21

From a technical perspective, the EUR/USD remains clearly bullish. The break above resistance at 1.1473 (April 11 high) has opened the way toward the psychological threshold of 1.1500, with the next relevant resistance located at 1.1498, the high recorded in February 2022. A sustained break above this level could pave the way for more ambitious targets around 1.1530 and 1.1575.

On the downside, initial support is found at the 200-day Simple Moving Average (SMA 200) around 1.0756, followed by the March 27 low at 1.0732, close to the 55-day SMA, which could provide an important technical support zone in case of corrections.

Momentum indicators reinforce the positive outlook: the Relative Strength Index (RSI) is hovering around 71, just above the overbought threshold, reflecting strong buying pressure, although it also suggests the possibility of a pause or pullback in the short term. Meanwhile, the Average Directional Index (ADX), above 47, indicates a solid trend in development.