EUR/USD Pair Moves Towards 1.100 Ahead of This Week’s Fed Meeting

The EUR/USD has started the week on a positive note and has returned to around 1.1090 in the early hours of the Asian session on Monday. Investors are focused on the long-awaited policy decision by the Federal Reserve this week. Markets continue to debate the size of the potential rate cut..

According to CME’s FedWatch tool, markets are forecasting about a 48.0% chance of a 25 basis point rate cut from the Fed at its meeting on September 17th and 18th. The chance for a 50 basis point rate cut has increased to 52.0% from 50.0% a day ago.

Investors will be paying close attention to the FOMC press conference for guidance on U.S. interest rates. If Fed Chairman Jerome Powell signals a more aggressive easing approach, there could be downward pressure on the U.S. dollar, potentially boosting the EUR/USD pair.

Gabriel Makhlouf, a member of the European Central Bank (ECB) Governing Council and governor of the Central Bank of Ireland, said Friday that the central bank still operates in a “very uncertain environment” and will be guided by data in making future monetary policy decisions. Makhlouf stressed that the ECB is not committed to a specific rate path, although it remains “determined to ensure” that inflation in the eurozone returns to the 2% target “in an appropriate manner.”

The Rabobank survey notes that the ECB announced its second rate cut of the cycle last week, with another cut expected before the end of the year. The latest ECB staff projections also show a downward revision to eurozone growth. While the Fed’s easing forecasts may weaken the dollar, Rabobank notes that unfavorable eurozone fundamentals could limit the upside potential of the EUR/USD pair in the near future.

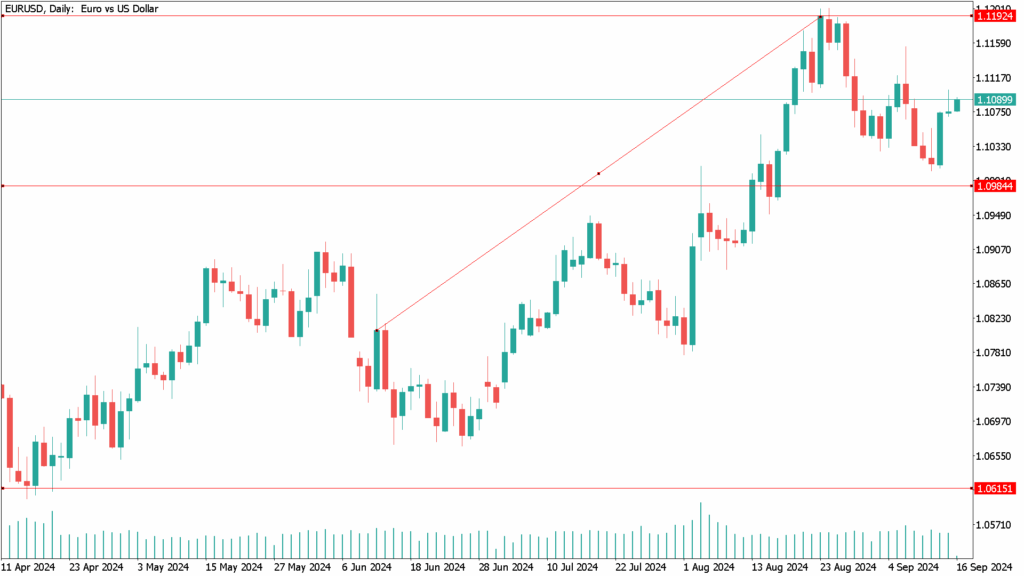

EUR/USD Daily Technical Analysis for September 16th:

Although the pair has retraced in the short term from the 13-month highs of around 1.1200 seen at the end of August, the downward pressure is facing significant challenges from Fibonacci buyers, with the pair resisting a pullback to the 50-day Exponential Moving Average (EMA) at 1.0984.

Close attention should be paid to this week’s events on the USD side to assess their impact on the pair. The market is currently divided over the potential magnitude of the interest rate cuts.