EUR/USD Pair Seeks Support on Downward Pressure

The EUR/USD pair tilted lower during the day on Tuesday, with intraday bids at two-week lows before the day’s session closed near 1.1050. Price action remains limited as markets are bracing for a final US Non-Farm Payrolls release this week, although a missed Purchasing Managers’ Index figure appears to have revived fears of an impending recession.

Significant European data remains limited in the first half of the trading week, and on Thursday, Fiber traders may be busy with a pan-European retail sales update for July, followed by U.S. labor data estimates ahead of Friday’s NFP jobs release.

July pan-European retail sales are expected to rebound slightly, with an estimated 0.1% y/y compared to last period’s -0.3% decline. Gross Domestic Product figures for Europe will also be released on Friday, with growth expected to remain unchanged from last quarter’s figures.

The ISM U.S. manufacturing PMI for August came in below estimates at 47.2 points, under the market’s consensus forecast of 47.5 points. Although there was a slight rebound from July’s multi-month low of 46.8, it failed to galvanize the markets, giving investors the opportunity to pull back from a recent bullish tilt.

Friday’s nonfarm payrolls report will be released, marking the last round of key U.S. jobs data before the Federal Reserve announces its latest interest rate decision on September 18. The Non-Farm Payrolls report is expected to set the tone for market estimates regarding the depth of a Fed rate cut, as investors assume the start of a new rate-cutting cycle this month.

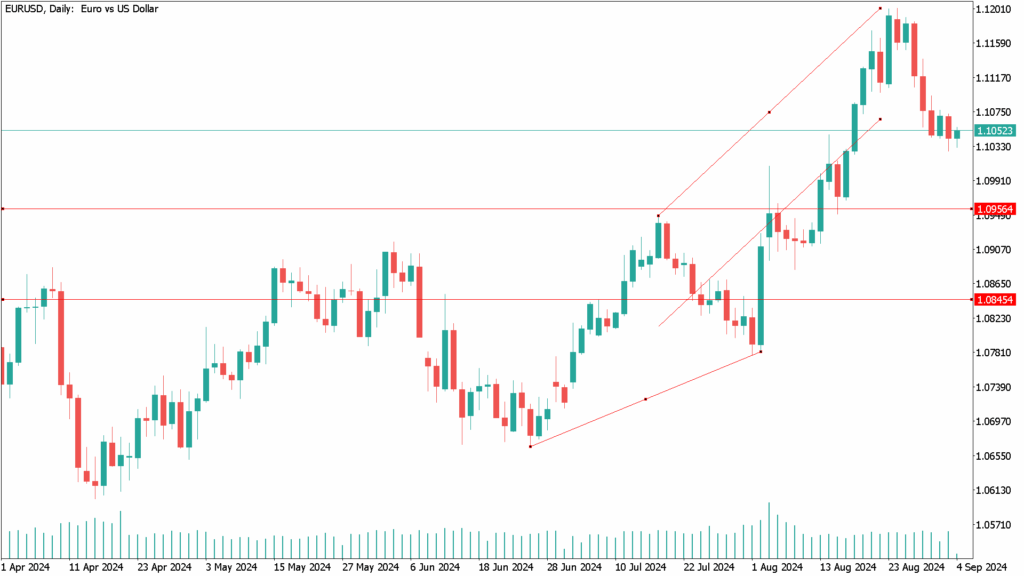

EUR/USD Daily Technical Analysis for September 4th:

FFiber prices have once again plunged into short-term technical hurdles, although traders continue to emerge in an effort to maintain balanced bidding, even if they fail to achieve a bullish recovery. EUR/USD set a 13-month high just above 1.1200 early last week, and a short-term pullback in the greenback’s moves has traders scrambling to maintain the bullish role on the charts.

The pair continues to trade north of the 200-day exponential moving average (EMA) at 1.0845. At the same time, despite remaining in the bullish zone, EUR/USD continues to face an increasingly sharp bearish pullback as shorts concentrate their positions on targets just above the 50-day EMA at 1.0956.