Daily Technical Analysis: EUR/USD Strengthens Above 1.0450 Following Conservative Victory in German Elections

The EUR/USD pair is attracting buying interest near 1.0480 at the start of Monday’s session, advancing on optimism surrounding the German conservative victory. Traders are closely monitoring the final German election results.

German Election Boosts Euro

Initial exit polls indicated that the German opposition conservatives, the Christian Democratic Union (CDU) and its partner, the Christian Social Union (CSU), secured the majority of votes in Sunday’s federal elections. This puts CDU leader Friedrich Merz on course to become the next chancellor, with the far-right Alternative for Germany (AfD) in second place.

The primary focus is now on how quickly the Christian Democratic Conservatives can form a coalition government to implement much-needed reforms in Germany’s struggling economy.

According to ZDF exit polls, the conservative CDU/CSU bloc won 28.5 percent of the vote, outperforming the far-right AfD at 20 percent, and the Social Democratic Party led by Olaf Scholz at 16.5 percent.

US Economic Data Weakens the Dollar

Weaker-than-expected US economic data also contributed to the euro’s gains. Data released by S&P Global on Friday showed that business activity in the US fell to its lowest level in 17 months in February.

The latest preliminary assessment revealed that the S&P Global Composite PMI for the US dropped to 50.4 in February from 52.7 in January. Conversely, the manufacturing PMI rose slightly from 51.2 to 51.6 during the same period. The services PMI declined from 52.9 in January to 49.7 in February, indicating a loss of momentum in the services sector.

Additionally, concerns about the US economy and renewed tariff threats from US President Donald Trump are adding uncertainty to global markets. This environment could potentially strengthen the US dollar (USD) and challenge the EUR/USD exchange rate.

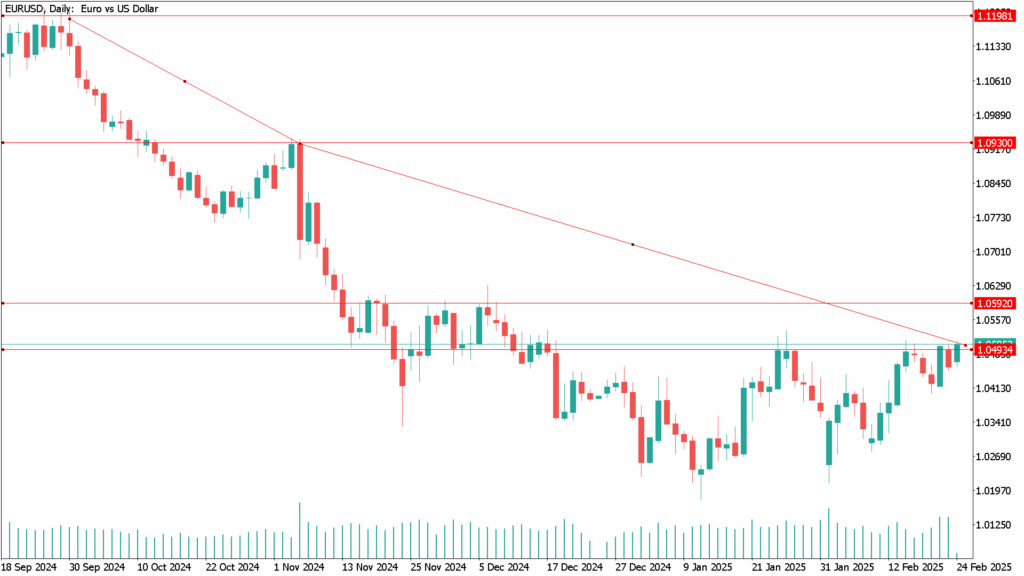

EUR/USD Daily Technical Analysis for February 24th

The daily chart for the EUR/USD pair shows that a slightly bullish 20-day simple moving average (SMA) has provided support throughout the week and is currently near the 1.0410 level. Meanwhile, a declining 100-day SMA is limiting upward momentum around the 1.0550 zone.

Technical indicators remain in positive territory, although they are showing signs of weakening, suggesting that buying interest is fading.

Resistance Levels: Resistance is located at 1.0527, the January monthly high, followed by the 100-day SMA at 1.0550. A sustained break above this level could target 1.0639, the December monthly high.

Support Levels: If the pair breaks below 1.0400, the price could drop to the 1.0320 area, with the next support at 1.0276, a significant weekly low.