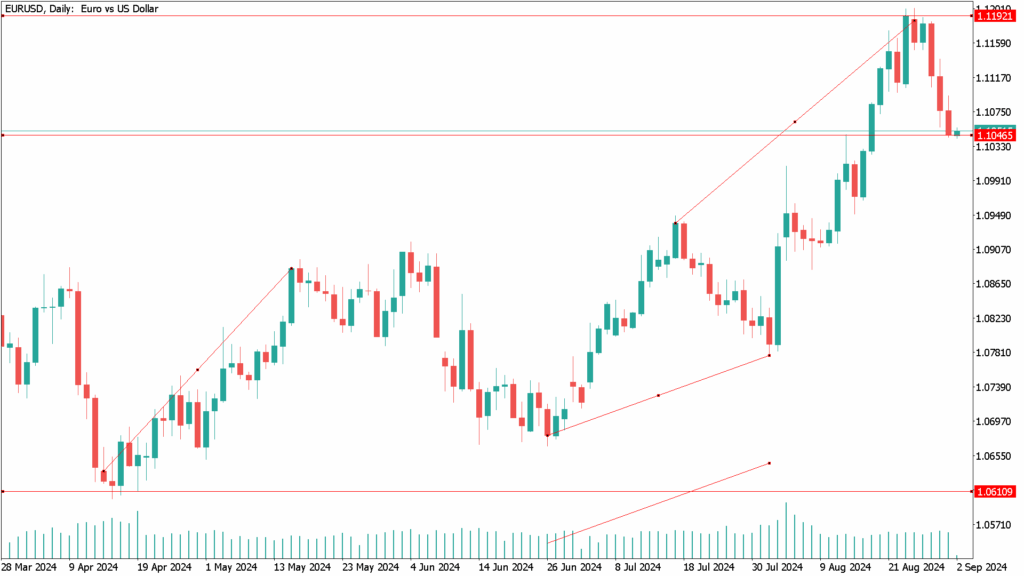

EUR/USD Rises to Near 1.1050 on Fed’s Dovish Tone

The EUR/USD breaks its three-day losing streak and trades around 1.1050 during the Asian session on Monday. The rise in the EUR/USD could be a consequence of the U.S. dollar’s lukewarmness following the negative sentiment surrounding the Federal Reserve. However, the July Personal Consumption Expenditures index may have supported the dollar and prevented the pair from rising further.

On Friday, the U.S. Bureau of Economic Analysis reported that the Personal Consumption Expenditures index increased by 2.5% year-over-year in July, matching the previous reading of 2.5% but below the forecast of 2.6%. On the other hand, the core PCE, which excludes volatile prices such as food and energy, increased by 2.6% year-over-year in July, in line with the previous figure of 2.6% but slightly below the consensus forecast of 2.7%.

According to CME’s FedWatch tool, markets fully anticipate at least a 25 basis point rate cut from the Fed at its meeting this month. Atlanta Fed President Raphael Bostic, one of the Federal Open Market Committee’s top hawks, signaled last week that the time may be ripe for a rate cut as a result of cooling inflation and a higher-than-expected unemployment rate.

François Villeroy de Galhau, a member of the European Central Bank’s (ECB) Governing Council, said on Friday, according to Bloomberg, that there are “good reasons” why the central bank should consider cutting interest rates in September. Villeroy de Galhau proposed action at the next meeting on September 12, noting that it would be fair and cautious to decide on a further rate cut.

EUR/USD Daily Technical Analysis for September 2nd:

After breaking its streak of losses over three straight days, it is now trading near 1.1050. It remains to be seen if the negative sentiment surrounding the Fed will become more pronounced when the stock market opens in the U.S.

The pair is likely to move more on the side of the U.S. dollar this week as the release of Non-Farm Payrolls and labor market-related data approaches. We will have to wait and see how the dollar reacts and whether oversold options are generated or if buying positions are secured.

We will see if the pair can return to higher levels this week near 1.105. A notable fact is that Labor Day is celebrated this Monday, so movement from the dollar side is likely to be minimal.