Daily Technical Analysis EUR/USD: Setbacks on the Eve of the Federal Reserve Interest Rate Meeting

The EUR/USD pair trimmed its gains of recent weeks on Tuesday, losing six-tenths of a percent and retreating slightly toward the 1.0400 level, as markets brace for another Federal Reserve meeting on Wednesday. Markets overwhelmingly expect the Fed to keep interest rates steady in January, although investors will be watching not only Fed Chairman Jerome Powell’s press conference but also any tweets from US President Donald Trump.

The economic calendar has no major data releases from Europe for the first half of the week. Traders will also have to wait for updates on Thursday regarding Gross Domestic Product data for both Germany and the pan-European zone in relation to the fourth quarter.

During the final hours of Monday, US President Donald Trump quickly resumed his aggressive tariff agenda, reiterating his intention to impose high tariffs on imports across various foreign goods and industries. This latest version of his plan includes vague tariffs on steel, aluminum, copper, and various semiconductors and microprocessors, aiming to force foreign companies to relocate their factories to the United States.

Convincing these sectors to move production to the US is a challenging task, as establishing factories domestically is often costly, and the US labor force demands significantly higher wages compared to countries that produce industrial goods on a larger scale. Consequently, import tariffs are unlikely to have a substantial influence on production decisions; instead, they may lead to inflation and a reduction in consumer spending.

The Federal Reserve is expected to announce its latest interest rate decision on Wednesday. While no change in the federal funds rate is anticipated this week, traders will closely monitor updates on the ongoing tensions between Federal Reserve Chairman Jerome Powell and President Trump. The Federal Reserve’s notable autonomy limits the White House’s influence over interest rates, a situation about which President Trump has previously expressed frustration. Trump’s recent claims that he will “demand” lower interest rates are expected to influence Powell’s upcoming press conference.

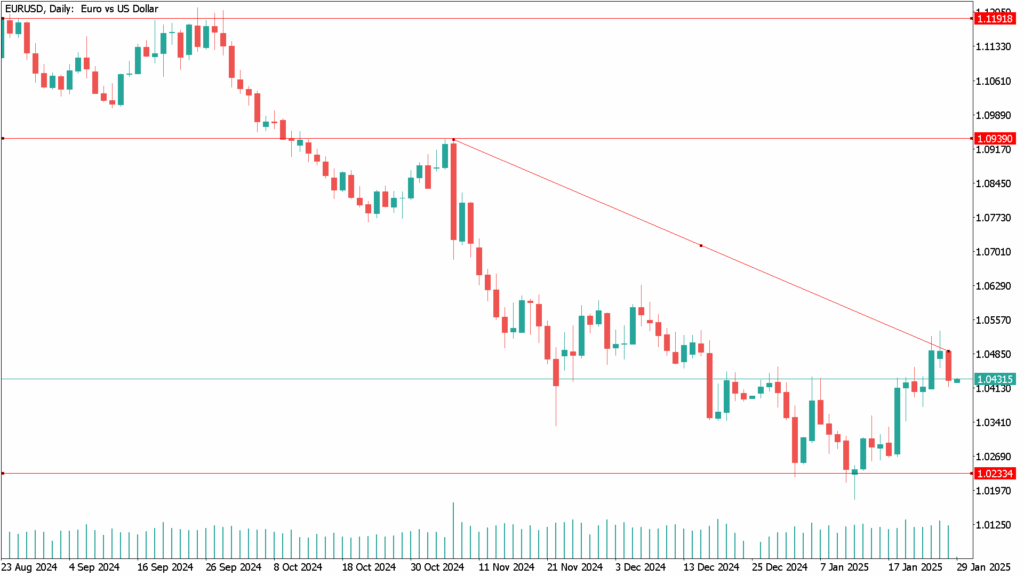

EUR/USD Daily Technical Analysis for January 29th

The euro’s decline against the dollar on Tuesday places the FIB in an unstable technical scenario. A bearish turn in EUR/USD offers is generating a rejection at the 50-day exponential moving average (EMA), which is falling to 1.0460. The pair is poised to suffer further losses on technical grounds unless bidders can push the price higher and initiate a trajectory toward the 200-day EMA, which sits just below the 1.0700 level.