Daily Technical Analysis: EUR/USD Gains Ground Above 1.1250 Ahead of U.S. Retail Sales Data

The EUR/USD pair is trading in positive territory around 1.1285 on Wednesday, with the U.S. Dollar (USD) hovering near a three-year low against the Euro (EUR) as global trade tensions persist. Market participants are closely watching for the release of U.S. retail sales data and a speech by Federal Reserve (Fed) Chair Jerome Powell, both scheduled for later in the day.

On Monday, Fed Governor Christopher Waller expressed concern over the Trump administration’s tariff strategies, calling them a significant shock to the U.S. economy. He suggested that the Fed may be compelled to cut interest rates to avert a potential recession—even if inflation remains elevated. Meanwhile, Atlanta Fed President Raphael Bostic struck a more cautious tone, stating that the central bank should maintain its current policy stance until more economic clarity emerges.

According to the CME FedWatch Tool, markets are currently pricing in nearly 85 basis points of rate cuts by year-end, although consensus expects the Fed to keep rates unchanged at its next meeting.

ECB Poised for Another Rate Cut

In Europe, the European Central Bank (ECB) is widely expected to cut interest rates by 25 basis points on Thursday, as recession concerns mount due to U.S.-driven trade turmoil. Hadrien Camatte, Senior Economist at Natixis, anticipates that the ECB could lower all three key rates at the upcoming meeting. The central bank has already reduced the deposit rate to 2.5% following two consecutive cuts, and a further decrease would bring it to 2.25%.

Fundamental Drivers to Watch

Looking ahead, EUR/USD will remain heavily influenced by central bank policy expectations, risk sentiment, and the outlook for Eurozone economic recovery. With uncertainty surrounding global trade and monetary policy, traders should prepare for continued fluctuations in the days to come.

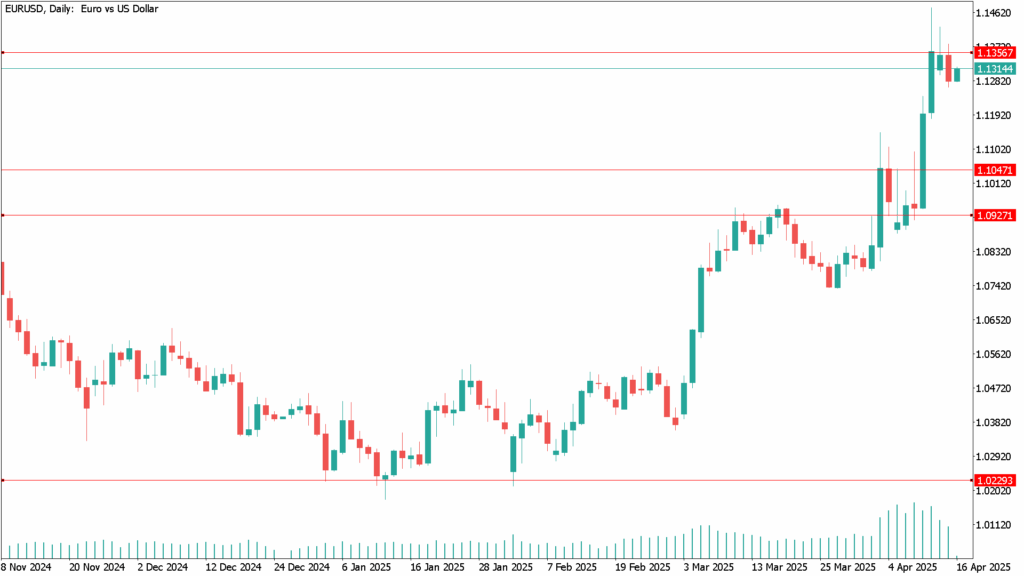

EUR/USD Daily Technical Analysis for April 16

EUR/USD remains on an upward path, and a break above the 1.1400 resistance level could trigger additional technical buying, paving the way for a potential bullish breakout. The daily chart shows momentum indicators such as the 14-day RSI, Stochastic, and MACD approaching overbought territory. However, traders should exercise caution against premature profit-taking unless the euro gains further fundamental support.

If EUR/USD fails to hold its current levels, a pullback toward the 1.1200 and 1.1120 support zones could unfold. A confirmed break below the key psychological level at 1.1000—and more critically, 1.0880—would signal a trend reversal and reinforce bearish control.

As long as EUR/USD stays above 1.1000, the broader trend remains bullish. This level continues to be a vital battleground for bulls aiming to sustain upward momentum. That said, heightened volatility from ongoing global trade policy shifts may cause sharp and unexpected moves in the pair. The Simple Moving Average (SMA) also supports the strength of the current bullish reversal.